North Texas CRE healthy heading into 2019

DALLAS-FORT WORTH – Fourth quarter 2018 commercial vacancy rates across North Texas were well below their estimated natural rates, according to the Real Estate Center’s first-ever Texas Quarterly Commercial Report.

DALLAS-FORT WORTH – Fourth quarter 2018 commercial vacancy rates across North Texas were well below their estimated natural rates, according to the Real Estate Center’s first-ever Texas Quarterly Commercial Report.

Office

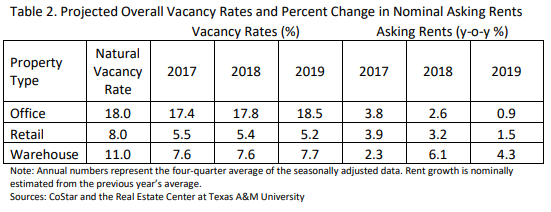

Actual vacancy (17.8 percent) continued to mirror the natural vacancy of 18 percent. Rent growth saw a slight uptick in 4Q2018, ending the year at 2.6 percent.

Net absorption at the end of 2018 was DFW’s best in two years.

In 2019, actual vacancy is expected to average 18.5 percent. Rental rates are projected to average 0.9 percent.

Retail

Actual vacancy measured well below the natural vacancy rate of 8 percent at 5.5 percent. Rent growth slowed last quarter and ended 2018 at 3.2 percent.

Net absorption has continued to be positive, which indicates strong demand for Dallas retail space, but new construction has not kept pace with that demand.

In 2019, actual vacancy is expected to average 5.2 percent, and rent growth is expected to slow to 1.5 percent.

Warehouse

Actual vacancy has measured below the natural vacancy of 11 percent since 2012, coming in at 7.6 percent in 2018.

Asking rent growth, after largely trending downward through 2017, ended the year at 6.1 percent.

In 2019, actual vacancy is expected to average 7.7 percent, and rent growth is expected to average 4.3 percent.

In This Article

You might also like

Publications

Receive our economic and housing reports and newsletters for free.