NAI Partners: Spotlighting South Submarket’s industrial vacancy

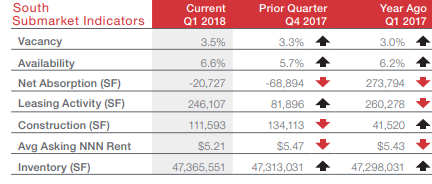

HOUSTON – Industrial vacancy remains tight, while demand continues to slow and NNN average asking rates remain steady, according to NAI Partners’ "South Submarket Spotlight 1Q 2018."

HOUSTON – Industrial vacancy remains tight, while demand continues to slow and NNN average asking rates remain steady, according to NAI Partners’ "South Submarket Spotlight 1Q 2018."

In the South submarket, there are approximately 47 million sf of industrial space made up of 36 million sf of Warehouse/Distribution space, 9 million sf of Manufacturing, and 2 million sf of Flex.

Overall vacancy in the submarket has remained below 4 percent for 17 consecutive quarters, and has maintained a low five-year, and ten-year average of 3.4 percent.

During the last four quarters, the South submarket has had more tenants moving out of space than tenants moving in; as a result, the submarket has reported slow demand.

Warehouse/distribution rates held steady at $5.49, while manufacturing rates have also lingered within a few cents of $4.75 per sf.

In This Article

You might also like

Publications

Receive our economic and housing reports and newsletters for free.