Jan 10, 2018

CBRE: Steady leasing pushes down vacancy

SAN ANTONIO – CBRE San Antonio released its 4Q 2017 Office MarketView. Fourth quarter 2017 activity pushed annual net absorption to 426,235 sf:San Antonio’s CBD submarket reported the largest net absorption in 4Q 2017;The Northwest submarket...

SAN ANTONIO – CBRE San Antonio released its 4Q 2017 Office MarketView.

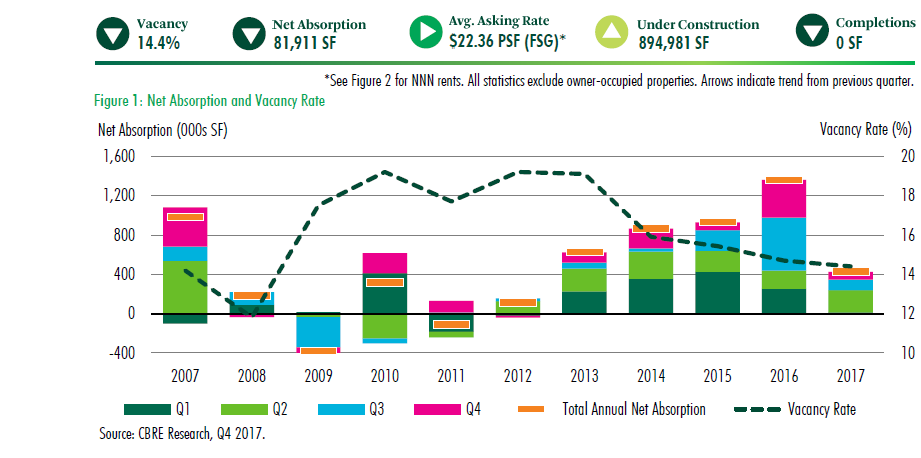

Fourth quarter 2017 activity pushed annual net absorption to 426,235 sf:

- San Antonio’s CBD submarket reported the largest net absorption in 4Q 2017;

- The Northwest submarket followed with healthy leasing activity.

The market’s vacancy rate fell to 14.4 percent, down 30 basis points from a year ago due to steady positive movements and the absence of new deliveries.

Weighted average asking rents for office product grew 3.8 percent during the trailing four quarters ending 4Q 2017.

- Growth was largely anchored by Class A product, which has grown 4.9 percent during the same period;

- Separately, NNN asking rents for Class A spaces have grown 9 percent since 4Q 2016.

The office market saw no new deliveries, however, construction is underway on six projects totaling 895,000 sf with an expected pre-leased rate of 40 percent.

In This Article

Topics

You might also like

SUBSCRIBE TO OUR

Publications

Receive our economic and housing reports and newsletters for free.