Dec 20, 2017

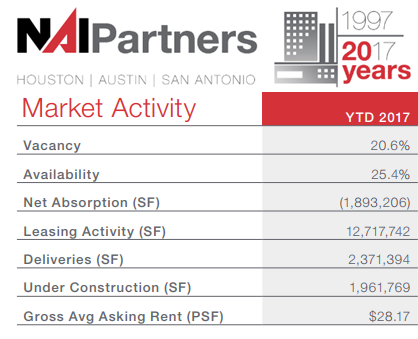

NAI Partners: Dec. 2017 Houston Office Market Snapshot

GREATER HOUSTON – Here are some December office market highlights from Houston Office Market Snapshot from NAI Partners:The largest commercial property in Houston CBD was sold.Brookfield Asset Management acquired the Houston Center, a 4.2 million-sf office and...

GREATER  HOUSTON – Here are some December office market highlights from Houston Office Market Snapshot from NAI Partners:

HOUSTON – Here are some December office market highlights from Houston Office Market Snapshot from NAI Partners:

The largest commercial property in Houston CBD was sold.

- Brookfield Asset Management acquired the Houston Center, a 4.2 million-sf office and retail complex.

- The 9.2-acre, 6.5-block property includes five properties along Fannin St. and McKinney St. and Lamar Ave., including three high-rise office towers and a 16-story office building over 196,000 sf of retail space.

Office sales volume are up 137 percent year-over-year.

- Real Capital Analytics data reports YTD office sales volume in the Houston area at $3.8 billion, a year-over-year increase of 137.6 percent.

Also, The Greater Houston Partnership is cautiously optimistic about job creation and the Houston economy for 2018.

In This Article

Topics

You might also like

SUBSCRIBE TO OUR

Publications

Receive our economic and housing reports and newsletters for free.