Oct 17, 2017

CBRE: Houston Retail MarketView 3Q 2017

HOUSTON – CBRE has released the third quarter 2017 Houston Retail MarketView report. Interested in submarkets? Then this report is for you!Key Highlights: Harvey impact minimalA dwindling pipeline, temporary requirements, increased demand from home improvement...

HOUSTON – CBRE has released the third quarter 2017 Houston Retail MarketView report.

HOUSTON – CBRE has released the third quarter 2017 Houston Retail MarketView report.

Interested in submarkets? Then this report is for you!

Key Highlights:

Harvey impact minimal

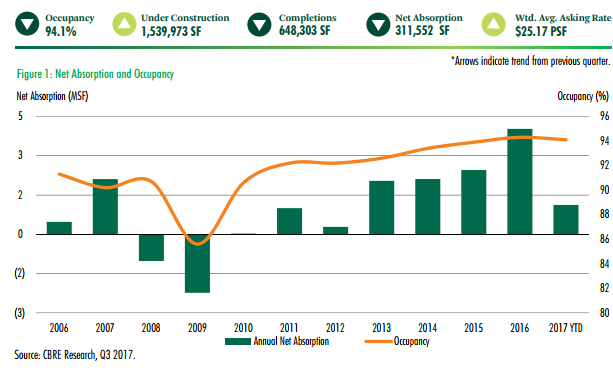

- A dwindling pipeline, temporary requirements, increased demand from home improvement tenants, and sustained organic retail demand will keep Houston retail in very tight conditions.

- Prior to Harvey, Houston’s Class A retail market was 97.2 percent occupied. Since the storm, Class A occupancy has increased to 97.6 percent—approximately 35 basis points.

New developments capture bulk of absorption

- Almost all of the 311,552 sf of new absorption was taken up by newly delivered centers, including the Grand Parkway Marketplace located in the Far North submarket.

- Year-to-date, over 2 million sf was absorbed in new development—counterbalancing national closures and bankruptcies.

- Although more speculative strip centers are underway, projects delivered in third quarter 2017 were 89 percent leased. Of the 1.5 million sf currently under construction, 71 percent is pre-leased.

Consumer Outlook

- Retail sales should continue to see gains, especially in the automotive, home improvement, furniture and appliance segments.

In This Article

Topics

You might also like

SUBSCRIBE TO OUR

Publications

Receive our economic and housing reports and newsletters for free.