Victoria at a Crossroads

Although Victoria is still feeling the effects of Hurricane Harvey, 2017 was a good year for the city in terms of home sales. The local economy is down, but industrial growth and Eagle Ford activity could signal a turnaround. |

More than a year after Hurricane Harvey, Victoria’s housing market is still feeling the storm’s effects.

Despite the setback late last year, Victoria finished 2017 strong with 816 home sales. The market had 802 sales in 2016, and the annual average number of sales since the start of the decade has been 773. Like other Texas coastal metros, Victoria began 2017 with positive first quarter and second quarter year-over-year sales before slumping in the third quarter and rebounding in the fourth. The city had a third quarter year-over-year sales drop of 9.4 percent and a fourth quarter spike of 10.8 percent.

Even before the storm, Victoria was already at the end of a real estate cycle that began toward the beginning of the decade. Hurricane Harvey added additional short-term distortions that have created conflicting market indicators. Ultimately, before the housing market can substantially improve, the city’s economy needs a kickstart.

Don’t Let Prices Confuse You

Sales volume and prices alone suggest the housing market may be gaining ground. Overall prices had been in decline since 2015 when the year-end median price was $174,900. By the end of 2017, median price reached $165,000; the previous year it was $169,900. But the year-to-date median price as of second quarter 2018 reached $171,500. Median price per square foot was $105 in 2015 but fell to $103 and $96 the following two years. Year-to-date median price per square foot as of June 2018 was $101.

The Federal Housing Finance Agency’s home price index, a measure of individual home price appreciation, indicates a similar trend where metro prices rose continually year over year from 2012 through 2015. After that, the index displayed a lot of volatility until Hurricane Harvey. The index finally depressed in the final two quarters of 2017 before climbing back up in 2018.

Because of the storm, it is still too early to tell if home prices have turned around. Major natural disasters often create “noise" in a market as homes come on and off the market and get repaired and rebuilt. Conditions gradually return to market levels. This can cause a major shift in the mix of homes available to purchase, which can result in confusing areawide housing metrics. This appears to be happening in Victoria.

One sign of market health is days on market. After bottoming out at a month and a half to sell in 2014, the average market time to sell a home in 2017 was almost three months.

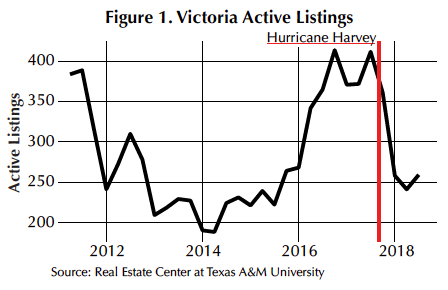

Another sign is active listing count, which had been on the rise since 2014, the year before rig counts in the Eagle Ford Shale dropped dramatically. For the next two years, listing count generally stayed in the mid 200s, lower than the long-term annual average of nearly 300 (Figure 1). Listings peaked the month before Hurricane Harvey at 428 but fell to 259 by June 2018. The sudden swing of listings also occurred in Houston and Beaumont during the same period.

Inventory in Decline

Without as much change in overall sales volume as Houston and Beaumont, Victoria’s housing inventory levels fell. Since September 2017, months inventory has been in double-digit, year-over-year decline and as of June 2018 was 3.6 months (Figure 2).

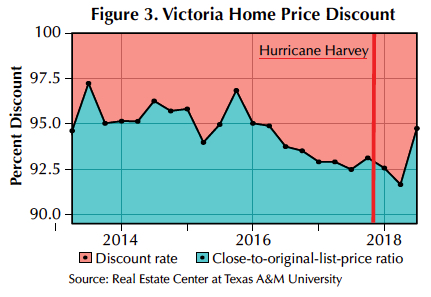

Storm effects and volatility in oil markets had a hand in reducing housing inventory. According to Federal Emergency Management Agency (FEMA) disaster records, almost 25,000 households—both owners and renters—registered for FEMA assistance after Hurricane Harvey. Of those registrants who were homeowners, less than two-thirds claimed to have homeowners insurance, and even fewer had flood insurance. Chances are, homes that would have been listed are still being repaired or waiting to be repaired. Homes that sold immediately in the two quarters after the storm may have sold at prices considerably less than what owners were originally asking for. During this period, the close-to-original-list-price ratio fell before recovering in second quarter 2018 (Figure 3). Until the dust settles, pricing trends may continue to be volatile.

Looking Ahead

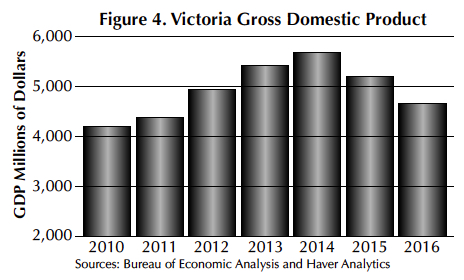

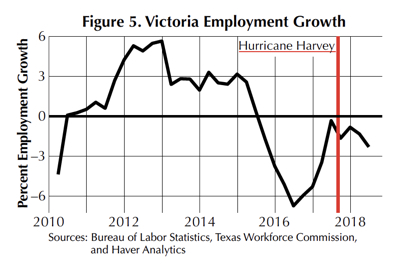

As more homes are put on the market, prices may drop again since Victoria remains in a down economy. Metrowide gross domestic product (GDP) peaked in 2014 at $5.6 billion at the height of the Eagle Ford oil play, but it has declined every year since (Figure 4). Quarterly employment growth almost returned to positive territory before the storm but stayed negative and fell further after Harvey (Figure 5). Key industries such as transportation, manufacturing, and construction haven’t bounced back yet. Other key housing market drivers also remain down, including household incomes and population growth.

Alcoa’s Point Comfort plant closure in 2016 was a major blow to the region with close to 700 jobs lost, and work still needs to be done to clear storm sediment to restore local ports to full capacity.

There is some good news. Formosa Plastics Corp. recently announced a $5 billion expansion of their facility in nearby Jackson County that is anticipated to provide about 340 jobs. At the same time, the Eagle Ford Shale is gradually showing signs of life again, which should help boost port activity.

Slowly but surely, Victoria and the surrounding region is picking itself back up.

____________________

Roberson ([email protected]) is a senior data analyst with the Real Estate Center at Texas A&M University.

You might also like

Publications

Receive our economic and housing reports and newsletters for free.