Takeaway |

One of the most important decisions homeowners face is selecting the appropriate amount and type of home insurance coverage. Understanding how much property insurance to purchase on the home requires knowing:

- certain insurance policy terms, conditions, and definitions, some of which are not clearly stated in many insurance policies; and

- being aware of claims settlement practices, which are rarely disclosed.

Failure to select the appropriate amount of insurance can result in over-insuring, which is a waste of premium dollars, or under-insuring, which can lead to unpleasant surprises at the time of a loss.

Selecting the Right Policy Form

The homeowner’s first challenge is selecting the policy form providing the option for types of perils or causes of loss which are insured against, as that decision controls other decisions. Broadly speaking, there are three options:

- HO-1 and HO-2 are “named perils” policies in which only the ten or 16 specifically listed causes of loss are covered;

- HO-3 is an “all-risk” or “open perils” policy in which all losses to the dwelling are covered unless specifically excluded, but personal property is covered for only 16 named perils: and

- HO-5 is an “all-risk” policy for both the dwelling and personal property.

HO-3 is the most frequently selected type of insurance, with HO-5 being second-most common and HO-2 being third. Additionally, there are four other types of forms for homeowners with specific types of residences:

- HO-4, for renters, providing personal property coverage only;

- HO-6, for condo owners;

- HO-7, for mobile home or manufactured home owners; and

- HO-8, for owners of older homes that do not meet insurer standards for other policy forms.

Four Basic Types of Coverage

After selecting the form, the homeowner needs to understand the four basic types of property coverage offered:

- Coverage A applies to the dwelling but does not cover any land, including land the dwelling occupies.

- Coverage B applies to structures at the insured premises other than the dwelling, such as a detached garage, outbuilding, fence, or the like.

- Coverage C applies to personal property.

- Coverage D applies to additional living expenses if the dwelling is unfit for occupation.

These brief explanations of types of coverage are based on the Insurance Services Office (ISO) HO policy forms, meant to capture only the essence of the property coverage, and are subject to many restrictions, qualifications, and exclusions. Not all insurance companies use the standard ISO forms, and of those that do, some may modify or alter them. The homeowner should always refer to the policy language or consult a trusted insurance expert for a more detailed analysis of the policy language.

The selection of coverage limits begins with Coverage A. Coverage B, C, and D are automatically included as a percentage of Coverage A. Generally, the limits provided for Coverage B, C, and D are 10 percent, 50 percent, and 20 percent, respectively, although higher or lower limits can be selected to tailor the coverage to the homeowner’s specific needs and in accordance with the insurance company’s underwriting and rating rules.

How Coverage Limits are Determined

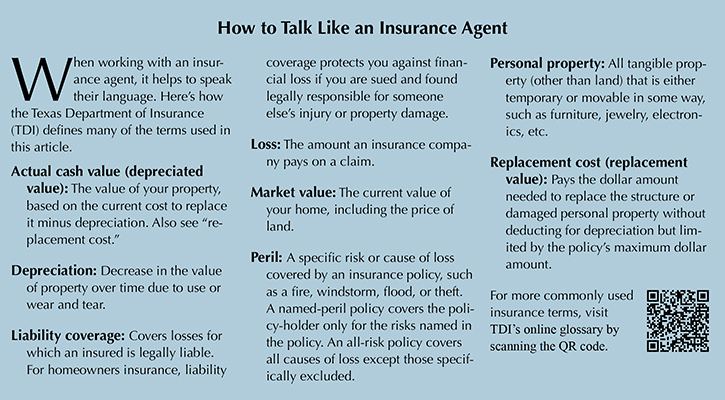

To make an appropriate selection of limits, the homeowner must understand the three common values placed on a house. Homeowners’ coverage limits are based on replacement cost (also known as replacement value), depreciated value, and market value.

The first valuation, replacement cost, applies to Coverage A and Coverage B. This term is not defined in the definitions section of the ISO homeowners policy but is explained in the conditions section under “Loss Settlement” (or similar language in non-ISO policy forms such as “How Losses Are Settled”). In the “Loss Settlement” clause, replacement cost is explained: “. . . we will pay the cost to repair or replace, after application of any deductible and without deduction for depreciation. . . (2) the replacement cost of that part of the building damaged with material of like kind and quality and for like use.”

This quasi-definition is in accordance with the general custom and practice in the insurance industry. The term “full replacement cost” is explained later in the policy wording. HO-2, HO-3, HO-5, HO-6, and HO-7 provide replacement cost on Coverage A and B automatically, while HO-1 and HO-8 do not.

The second valuation is depreciated value, commonly known as actual cash value or ACV. While some homeowners’ policies define ACV, the standard ISO policy does not. In those cases, its definition varies from state to state in accordance with statute or case law. If a homeowner’s policy issued in Texas does not define ACV, it is roughly equated with fair market value (U.S. Fire Ins. Co. V. Stricklin, 556 S.W.2.d, 575, 582 [Tex. Civ. App. 1977]). In a small number of states, specific statutes may provide the definition. Most states use the broad evidence rule, which considers many factors in the development of the ACV. Other interpretations are used in six other states.

In the section on “Loss Settlement,” losses to damaged covered property insured under Coverage C, Personal Property, are settled on the ACV basis. In the rarely used HO-1 or in the HO-8, Coverage A, the dwelling is valued at ACV.

The third valuation is market value. The market value or “real estate” value of the house represents the value that a willing buyer and a willing seller agree on. For basic insurance purposes, this value is not used.

However, this value may have some bearing on the selection of coverage limits and the arrangement for financing the purchase of the home. The market value represents the purchase price of the home, but that value includes more than the replacement cost of the building. That transaction includes the land on which the home is located as well as value derived from the surrounding area, such as from quality of schools, proximity to shopping and recreational opportunities, convenience of means of transportation, scenery, and the like. The value derived from the surroundings is not covered in the homeowner’s policy, and land is specifically excluded from property coverage, hence market value is not directly used in selecting coverage limits.

Occasionally, a problem may arise when arranging financing. A mortgage lender may require Coverage A limits equal to the loan amount, an amount that is essentially the market value less any down payment or deposit.

For example, assume a homeowner purchases a desirable home for $600,000 and makes a down payment of $50,000. An appraisal might place the value of the lot at $100,000 and the replacement cost of the home at $400,000. A lender might attempt to require insurance of $600,000 less the down payment, but an insurance company might not be willing to “over-insure” the home, leading to an impasse in the closing process.

Required over-insurance by lenders is prohibited in Texas as well as in 38 other states (Texas Finance Code Title 3. Financial Institutions and Businesses, Subtitle E. Other Financial Businesses Chapter 180. Residential Mortgage Loan Originators.). A homeowner in Texas facing such a demand should ask the insurance agent to intercede or, in an extreme situation, involve the Texas Department of Insurance.

At the time the homeowner’s policy is purchased, the homeowner should use replacement cost for Coverage A to select the appropriate level of limits. This valuation may be available from the real estate professional handling the transaction and will be available from the insurance agent.

Alternatively, a homeowner could engage an appraisal service to provide a replacement cost-based valuation of the property. At each renewal, the homeowner should review coverage limits and make the appropriate upward adjustment in value to reflect inflation’s effect on building costs. Insurance companies may offer an endorsement automatically adjusting Coverage A limits upward to reflect inflation and increased costs of construction, repair, and replacement. The insurance company or insurance agent may also be of assistance in determining the effect of inflation on the home’s replacement value.

Coverage C, personal property, is valued at ACV, but a homeowner may wish to insure personal property on a replacement cost basis for an additional premium.

When Valuation Issues Occur

The purchasing of the insurance policy is not the only time the homeowner must be concerned about appropriate levels of limits. When an insured loss occurs, valuation issues will arise.

One issue has to do with replacement cost or replacement value, as there are three additional qualifiers applying to this valuation found in the “Loss Settlement” section. The definition of replacement cost for Coverage A and Coverage B continues with “we will pay . . . but not more than the least of the following amounts:

- the limit of liability under this policy that applies to the building;

- the replacement cost of that part of the building damaged with material of like kind and quality and for like use; or

- the necessary amount actually spent to repair or replace the damaged building.”

The last qualifier is the one most likely to cause issues for a homeowner, because it limits a loss payment to the money spent. If the homeowner does not repair or replace the damaged property and no money is spent, there is no loss payment, even though there was a loss to covered property.

Roof Damage

Another issue arises when the damaged property happens to be the roof.

While the roof is clearly part of the dwelling, a structure covered in Coverage A and automatically subject to replacement cost, damage to it may be reimbursed at ACV. In these instances, in keeping with individual insurance company claims settlement practices, losses to a roof are valued at the replacement cost of the new roof less depreciation for age and wear, because roofs are rated according to their expected useful life, such as 15- to 20-year three-tab shingles or slate shingles rated for 50 to 100 years.

Further, some insurance carriers specifically endorse the homeowner’s policy to pay only the ACV for damage to the roof surface caused by wind or hail. The homeowner must carefully review the policy to determine if this endorsement is present or ask the insurance agent how a wind or hail loss would be settled.

When There’s Inadequate Insurance

If there’s a covered loss, the insurance carrier will calculate the replacement cost of the home to determine if the insurance-to-value (ITV) clause of the policy applies. A homeowner feels the impact of under-insuring in one of two ways.

First, most insurance policies include an ITV provision requiring the homeowner to carry Coverage A limits equal to at least 80 percent of the home’s full replacement cost. According to the ISO policy form, in the “Loss Settlement” clause, “full replacement cost” does not include the “full” amount of the home, as footings, foundations, other undersurface supports, and underground flies, pipes, wiring, and drains are not included in the calculation.

If the homeowner fails to carry an ITV provision, a partial loss will result in a penalty imposed in the claim payment. The penalty for under-insuring is determined by the following formula: (insurance carried/insurance required at 80 percent) x loss. The deductible is then applied to the reduced loss to determine the final payment. If the 80 percent ITV provision is met, the loss payment is at 100 percent of the loss less any deductible.

Second, even if the 80 percent ITV provision is met, any loss in excess of the insurance carried is not covered because the policy limit is exhausted. The homeowner will receive the policy limit from the insurance company and pay the difference out of pocket.

While total losses are unlikely in nearly all situations, recent events such as wildfires, hurricanes, tornadoes, and floods demonstrate total losses are indeed possible.

Weighing Cost and Risks

When the homeowner considers the amount of insurance to purchase, the type of insurance, and the premium charged, they should consider the axiom, “Do not risk a lot for a little.” The premiums, as high as the homeowner may think they are, are much less than an uncovered loss.

Further, premiums can be included in the household budget and money set aside on a regular basis, but when an uncovered or partially covered loss occurs, that expense is an immediate and potentially significant financial hit.

The recommended course of action is to purchase insurance for 100 percent of the full replacement value and to annually update the limits to avoid an unpleasant shock to the household budget. If the household budget is tight, lowering the limits to 80 percent will lessen the premium, but that savings comes at the risk of under-insuring. Understanding valuation methods helps the homeowner make an informed decision.

____________________

Richard Rudolph, Ph.D. ([email protected]) is a research fellow with the Texas Real Estate Research Center and has 20 years of experience in insurance brokerage and 30 years of experience in insurance and risk management consulting and education.

You might also like

Publications

Receive our economic and housing reports and newsletters for free.