Staying Put

Housing tenure has been a big concern since the Great Recession. Many believe it can lead to chronic bottlenecks in housing churn, particularly in the entry-workforce housing market, ultimately causing a drag in supply. COVID has demonstrated that major changes in housing tenure can be caused by sudden demand shocks. |

The housing crash of the mid-2000s greatly altered the homebuying landscape. If the early 2000s were awash with easy credit and buyer optimism, the years that followed were a drought. Texas managed better than most other big states, but housing activity was still diminished.

Disruption from the housing crash inevitably manifested itself in homebuying patterns, such as housing tenure, or the length of time between buying a home and selling it. Since the housing fallout, typical homeowner tenure quickly lengthened, spurring concerns about housing supply, particularly in affordable price ranges.

Staying in Place Longer

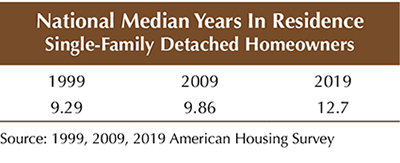

Housing tenure tends to be stable from year to year. In 1999, most single-family homeowners stayed in their homes a little over nine years before moving to their next residence, according to national data from the American Housing Survey (see table). Ten years later it was closer to ten, but by 2019, there was a noticeable shift to almost 13 years.

The American Community Survey’s state-level data tell the same story for Texas. In only ten years, the percentage of owners of single-family detatched homes stretching their tenure between ten to 19 years increased from 20 to almost 30 percent among those surveyed (Figure 1).

The housing crisis bears much of the blame. Texas housing demand was suppressed for years due to lingering economic uncertainty, loss of confidence in the housing markets, and massive shifts in the mortgage lending landscape. The low point for sales was 2010, when potential homebuyers sat on the sidelines while the market sorted itself out from the Great Recession.

By 2013, though, sales were ready to surpass the 2006 peak. Two years later, that sales record was finally eclipsed, and the Texas housing market hasn’t looked back since. However, despite aggressive sales growth, housing tenure continued to climb.

Affordability Crunch

With increased home sales came increased inventory turnover. Housing turnover rates in Texas’ largest metros started ticking back up in 2012 and stabilized by 2017 (Figure 2). Despite the increase in overall churn, there was a noticeable absence of houses in the affordable price range.

The housing crash brought new-home construction to a screeching halt. While new-home sales have more recently inched closer to peak levels from the 2000s, the price offerings have narrowed tremendously. As land prices continued to rise, the price of affordable entry-level homes climbed considerably.

The affordability crunch spilled over into the existing-home market as well. Mortgage rates and population growth both played a big role in Texas.

While mortgage rates are often a driver for home purchases, mortgage originations at the national level shifted heavily in favor of refinances between 2009 and 2013 (Figure 3), with the 30-year fixed mortgage rate hitting its lowest point for that period in 2012 and 2013.

At times, refinances accounted for close to 60 percent of total origination volume. Separate data from the Consumer Finance Protection Bureau suggest it may have been closer to 50 percent in Texas. Regardless, a significant number of Texas households took advantage of low rates during the slow national economic recovery and refinanced their existing homes.

As the decade progressed, Texas had stronger population growth than the nation at large, and household growth in the major metros, particularly the “Big Four," surpassed the state. The massive migration of households to the Lone Star State placed a major squeeze on housing supply.

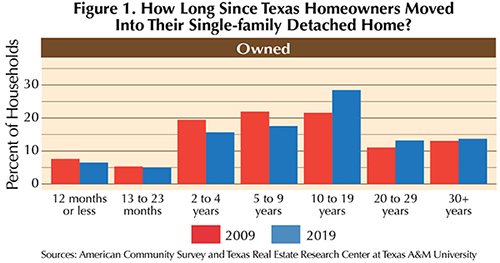

The scarcity of homes in the entry-level market worsened over time. In Texas’ two largest markets, Dallas-Fort-Worth-Arlington and Houston-The Woodlands-Sugar Land, homes priced in the $100,000s used to dominate Multiple Listing Service (MLS) activity. From 2013 to the end of the 2010s, the price cohort for affordable homes gradually shifted from the $100,000s to the $200,000s (Figure 4). With fewer affordable homes in circulation, many potential buyers simply had fewer options, resulting in longer stays in their current homes.

The Big Upgrade

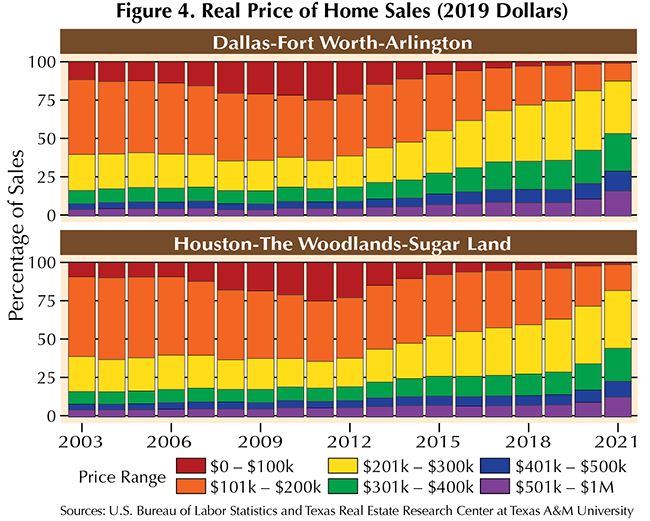

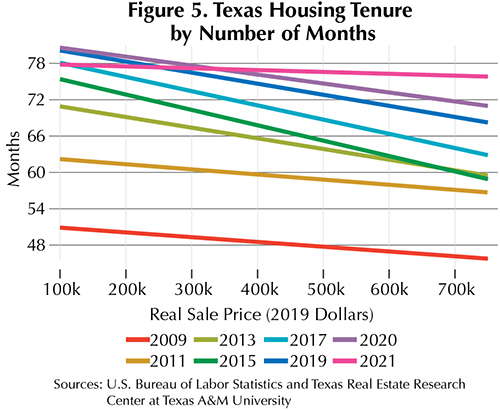

Immediately after the Great Recession, housing tenure in Texas increased for all homeowners regardless of income, home value, or family dynamics. After 2009, though, entry-level homes drove tenure growth (Figure 5). Since COVID, the gap between the two ends has quickly narrowed.

The trend is easiest to spot in the most intense housing markets, such as the state’s four major metros.

By mid-2021, the housing tenure for the highest-priced homes in Austin was more than seven years, whereas homes at the opposite end of the price spectrum typically changed owners six months sooner. In prior years, not only were the roles reversed, but there was a much wider gap due to housing scarcity. Given the timing, it’s clear that COVID, at least indirectly, is responsible.

Texas’ housing market didn’t take long to rebound after shelter-in-place restrictions were lifted in 2020. Historically low mortgage rates helped, but not all segments of the purchase market benefited from them. With the sudden spike in purchasing power and the COVID-induced urgency to expand, many households took the drop in rates as a sign to upgrade.

Unlike in the affordable-home market, the sudden change in housing tenure in the higher-priced market is likely to be short-term. Rates are already starting to increase, and the wave of out-of-state buyers, particularly from California, is likely to wane sooner than it did during the COVID rush.

The narrowing tenure between the high and low ends of the housing market will likely end up being one of many quirks in the post-pandemic housing market, and understanding it may take some time.

____________________

Roberson ([email protected]) is a lead data analyst with the Texas Real Estate Research Center at Texas A&M University.

You might also like

Publications

Receive our economic and housing reports and newsletters for free.