Retreat or Resurgence

Despite the toll the pandemic took on the Texas economy, the state’s housing market is faring well overall. Sales continue to rise, and new construction is up. While homeowners are confident about being able to pay their mortgages, renters, who generally have fewer financial resources, are less certain. |

Years from now, what will people remember about the COVID-19 pandemic? Social tensions? Hand-washing jingles? Those following the economy will perhaps recall the housing market’s surprising resiliency.

Few expected such a rapid recovery in the housing market, especially after the last recession caused by the mortgage market collapse. Unlike last time, the housing market may end up the economic hero of 2020.

High Demand for Texas Housing

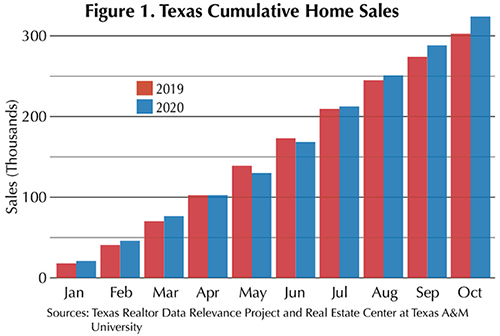

Texas housing has been in strong demand in the wake of the pandemic and shelter-in-place restrictions. Home sales had an impressive surge in June and July. By the end of summer, year-to-date sales had roared back, and the market was poised for another consecutive year of annual sales growth (Figure 1). How has demand managed to be so robust despite chaos in the overall economy, and how long could it last?

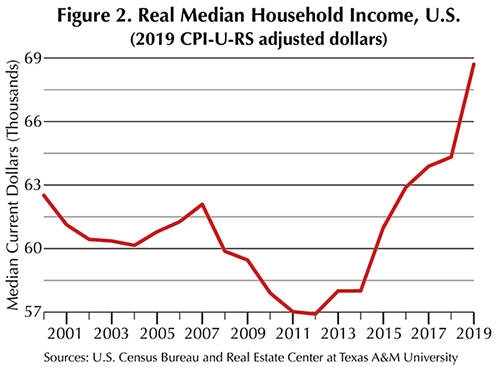

Before COVID, the U.S. economy was in great shape by almost any metric. National unemployment rates had dwindled to historic lows, and labor participation was on the rise. The tightening slack in the labor market resulted in a significant boost in real income growth in 2019 (Figure 2). Texas was among the states leading economic growth for most of the decade. No wonder many Texas households were as prepared as possible for the economic headwinds brought on by the pandemic.

Millennials Make Their Move

Bottomed-out mortgage rates ignited a “now or never" mentality for many potential homebuyers. One demographic, in particular, benefited from the low rates. After much anticipation, the long-awaited wave of millennial homebuyers rolled in, and just in time.

Actually, a growing number of millennials had already begun entering the housing market in recent years, but their potential had not yet been fully realized. Then last year the National Association of Realtors reported that older millennials (those born in the 1980s) made up the largest age cohort of buyers in 2019, claiming a quarter of all home purchases. Over half of these were first-time buyers. As millennials continued to form families and earn more, home-sale expectations were primed for a big year in 2020. That was before the COVID pandemic.

Fortunately, data from throughout the year suggest millennials lived up to expectations. According to Realtor.com as well as other industry experts, millennials were responsible for the largest share of primary home purchase mortgages in 2020. In fact, their share has grown sharply as Gen Xers’ and baby boomers’ shares have diminished. This bodes well for Texas’ housing outlook provided the trend continues.

Texas has a larger proportion of millennials than the nation as a whole (Figure 3), and not only in its four largest metros. Cities such as El Paso, Killeen-Temple, and Lubbock have millennial populations that are higher than the national average, and most of those metros are having better home sales in 2020 than they did in 2019.

Sales Sizzle or Fizzle?

Unfortunately, pushing mortgage rates down to historic lows could be like pouring lighter fluid on a fire. In other words, without a steady supply of home listings to fuel the market, sales growth could fizzle out soon after the initial burst.

At current supply and demand levels, homes are flying off the market at escalating prices. The aggregate supply of homes in Texas is beginning to resemble the most intense submarkets, such as Austin and North Dallas, during the heights of the past decade. In August 2019, the supply of homes was almost four months. A year later it was only two and a half months. Additionally, half the homes sold in Texas were on the market fewer than 22 days.

Mortgage Payment Peril

While many homeowners have jumped on the opportunity to buy or refinance at favorable rates in 2020, others have fallen seriously close to losing their homes. The Coronavirus Aid, Relief, and Economic Security (CARES) Act provided a safety net against both foreclosures and evictions. So far this year in Texas, CARES has successfully curtailed an onslaught of foreclosures.

Late payments were a different story. Nationally, loans in forbearance peaked in mid-May and have, for the most part, been in steady decline since then, according to data provider Black Knight.

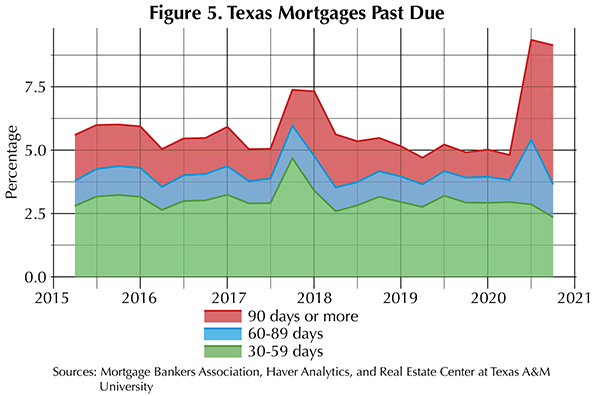

For all its merits, the CARES Act was always going to have limitations. Despite stimulus payments, many Texas homeowners fell behind on their mortgages payments even as foreclosures plummeted (Figure 4). According to data from the Mortgage Bankers Association, the percentage of delinquent Texas home loans jumped significantly in second quarter 2020, eclipsing the previous high from Hurricane Harvey in 2017. The biggest spike in the second quarter was in payments that were 90 or more days past due (Figure 5). However, the percentage for that category actually trended downward in the third quarter. Percentages for both the 30-59 and the 60-89-days-past-due groups also trended downward in the third quarter, which could signify another dip for the 90-day group in the fourth quarter.

Even with overall delinquencies on the rise, most Texas homeowners seem confident in their ability to pay their mortgages and perceive a minimal risk of foreclosure, according to weekly findings from the U.S. Census Bureau’s Household Pulse Survey (HPS).

Making Sense of Rents

While Texas homeowners have been fairly upbeat, the same can’t be said of renters. HPS data indicate renters were more likely than homeowners to suffer under the economic pressure brought on by COVID-19, both in the immediate aftermath and beyond. In general, renters earn less, save less, and have less income stability than homeowners, which means they have fewer safety measures to weather the storm. It’s no wonder renters are less confident than homeowners in being able to pay housing expenses and avoid eviction. As the recession has progressed, an increasing number of renter households have fallen behind on their payments.

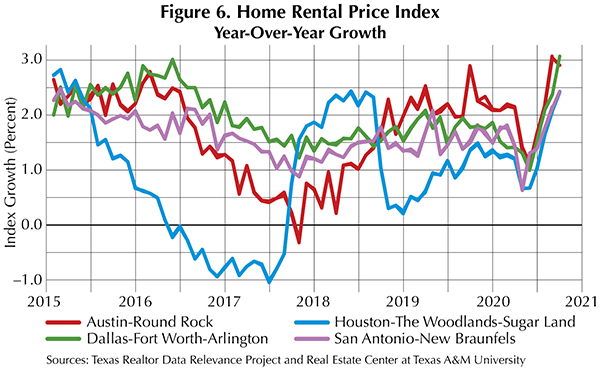

Strangely enough, much of the available rental data don’t reflect this doom and gloom. Rental activity through the Multiple Listing Service (MLS), which mainly includes single-family rental housing, has suffered negative shocks in rental inventories, but properties are still moving fiercely and rents are growing strong after a brief setback during the shelter-at-home restrictions (Figure 6).

Single-family renters have a lot in common financially with their homeowner counterparts. Most single-family rental homes are larger than multifamily rentals, at least by bedroom count, according to the Census Bureau. Extra space typically requires higher incomes and, in some cases, renters may end up paying more than homeowners for the same square footage, especially with mortgage rates spiraling downward.

In fact, in many housing markets throughout the state, the total cost of renting rivals overall homeowner costs. According to Census Bureau estimates, the largest housing expense cohort in Texas for both homeowners and renters is between $1,000 and $1,500 (Figure 7). Single-family properties are believed to dominate these estimates, which include total expenses, not just rent or mortgage payments.

Renters who participate in the HPS are often connected by their income differences. For example, those with lower incomes generally have more work-hour disruptions and more difficulty paying rent. They also tend to be young, single households, which are not as likely to buy or rent single-family dwellings.

In the current interest rate environment, higher-earning renters are likely tempted to buy a home. Unfortunately, many others have the same idea, making the home-search process incredibly competitive. If an existing home can’t be found, then perhaps a new one will do, which may be why the construction industry is booming.

Construction Comeback

Homes are in short supply, making builders the most unlikely of beneficiaries in the post-COVID economy. Despite starting off with intense pessimism, current homebuilder sentiment couldn’t be better according to polling from the National Association of Homebuilders (NAHB). New-home construction is regarded as a leading factor for economic recovery.

MLS sales of new single-family homes in August were unexceptional compared with June and July. But, like existing home sales, new-home sales had much ground to cover during the summer to recover, creating an unfair comparison. Year-over-year growth has still been good since August, and year-to-date sales are on track to exceed 2019. With the arrival of colder months, what lies ahead for homebuilders, and will there be enough demand to keep the momentum going in 2021?

Even though MLS new-home sales are less likely to include either custom home sales or sales from some major homebuilders, the overall new-home outlook still looks promising. Statewide, building permits have been on the rise since July. Assuming these permits follow through, they could give the state a much-needed economic boost. Nationally, foot traffic of prospective buyers remained unusually high late into the homebuilding season, according to NAHB data. Houston, which is leading the charge, could especially use the boost after a rough year in the oil patch.

Life After COVID

How Texas, the nation, and the world face continuing COVID-related challenges will have major implications on the state’s economy and housing market.

First, how and when will certain industry sectors iron out the economic shocks brought on by the virus? Take the oil industry, for example. After an acute market imbalance, how long will it take for oil demand and prices to stabilize and bring back jobs? A stalled recovery could have wide-reaching negative effects, such as soft housing demand, throughout much of Texas. The lumber industry, meanwhile, is seeing lumber prices escalate because of major supply chain disruption. Will severe price hikes in soft lumber hinder new home sales momentum, or will the market absorb the current price? So far, the market appears to have absorbed the higher lumber costs because of strong demand.

The amount of time it will take for households to bounce back is also cause for concern. Many renter households are still in financial distress and nowhere near recovery. Efforts have been made at both the state and local levels to protect renters from losing their homes, including allocating $176 million in federal funds to provide rental assistance in Texas.

This leads up to a very important question. How will either the economy or housing market handle itself without government assistance? For most of the pandemic both have been under the protective wing of various government interventions. Many economists project that the U.S. will not even begin recovery until well into 2021, but even those projections are uncertain. Texas will need to wait to find out if its housing market is in retreat, resurgence, or possibly both.

____________________

Roberson ([email protected]) is a senior data analyst with the Texas Real Estate Research Center at Texas A&M University.

You might also like

Publications

Receive our economic and housing reports and newsletters for free.