Over Hill, Over Dale

The Takeaway Despite a slowdown in activity, Texas land markets showed overall positive price trends in 2018. Only Far West Texas and South Texas had notable price declines. However, the number of sales dropped in all regions except the Panhandle and South Plains and the Gulf Coast-Brazos Bottom. |

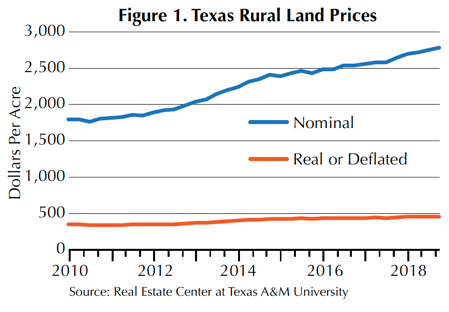

Texas land market activity slowed in fourth quarter 2018 but continued to show positive price trends. Overall land prices climbed at a moderate pace, reaching $2,779 per acre (Figure 1). Energy sector activity stoked demand for recreational and investment properties, driving the statewide price up 5.1 percent over the fourth quarter 2017 price. Those results revealed a deceleration in the rate of increase posted in the previous three quarters. The 6,193 reported sales fell 79 short of 2017’s volume. Total dollar volume ($1.29 billion) expanded 5.5 percent from 2017, reflecting a move to fewer total sales of larger properties.

Despite overall positive market conditions, some regions registered decidedly weak results. Prices declined in the energy-intensive regions of Far West Texas and South Texas, while the number of transactions declined in all areas except the Panhandle and South Plains and the Gulf Coast-Brazos Bottom.

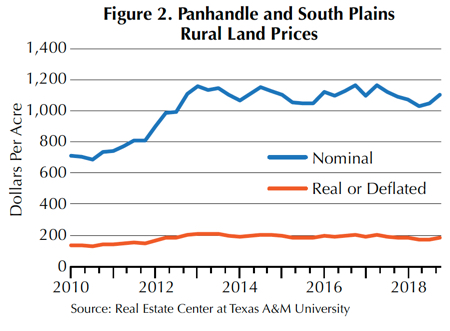

Panhandle and South Plains

Prices inched up a weak 1.4 percent from fourth quarter 2017, ending five straight quarters of price declines (Figure 2). The $1,104 per-acre price fell slightly short of third quarter 2017’s price of $1,119 per acre. This appears to have slowed the retrenchment driven by challenging agricultural operating conditions. The number of sales expanded slightly to 423. Poor operating conditions contributed to weak prices throughout the year. The small increase suggests declines may be over. However, a burst of activity related to 1031 transactions may have artificially increased the regional price. Proof of a recovery will depend on developments in the first half of 2019.

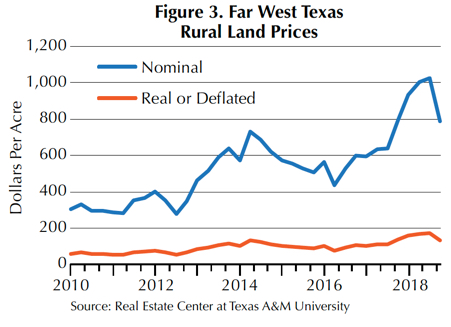

Far West Texas

Sand miners have satisfied their appetites for ranches in this region, but other oil-related ranch purchases boosted dollar volume slightly above the 2017 level. The number of sales declined. Industrial demand for land continued to support historically high prices. The regional price dipped below $1,000 per acre. At $788 per acre, prices were about 23.3 percent below third quarter 2018 prices but only 0.38 percent below fourth quarter 2017 prices (Figure 3).

Continued high-bonus payments for mineral leases and land purchases for disposal wells and other oil field uses supported prices at historically high levels. Total dollar volume amounted to $51 million, up 1.9 percent from 2017 and 26.9 percent from the average of the first three quarters of 2017. Prices in 2019 will likely fall well short of last year’s prices, which were fueled by the sand-mine frenzy.

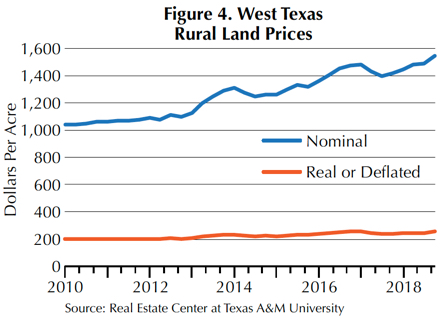

West Texas

In the fourth quarter, West Texas markets sent mixed signals with prices rising a respectable 9.1 percent (Figure 4) while sales volume plunged 6.4 percent to 644 sales. Total dollar volume ($138 million) moved up 9.9 percent. At 415 acres, typical size expanded 2.1 percent.

Northeast Texas

Driven by increased activity near Dallas, this area’s remarkable price growth shifted into high gear, climbing 11.4 percent to $4,421 per acre (Figure 5). However, buyers appear to be resisting climbing prices as evidenced by the number of sales falling 10.6 percent and dollar volume dropping 2.9 percent as well. Property size declined slightly from 114 to 112 acres.

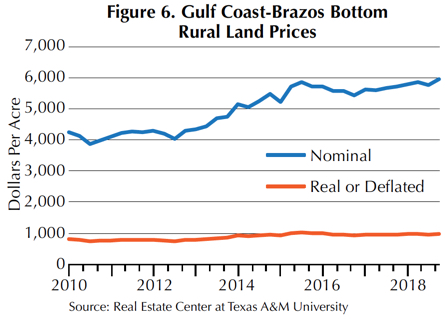

Gulf Coast-Brazos Bottom

Hurricane Harvey recovery contributed to improved market conditions in this region. Total dollar volume increased a remarkable 79.1 percent over the depressed fourth quarter 2017. Sales increased by 29.6 percent. The increased activity did not translate into major price changes; prices also increased nearly 4 percent to $5,955 per acre (Figure 6). The region had a 6.7 percent increase in typical size.

South Texas

South Texas markets produced a price of $3,695 per acre for a 3.4 percent decline from fourth quarter 2017 (Figure 7). However, size (–4.0 percent) and total dollar volume (–19.0 percent) contracted significantly, pointing to a weakening market. Eagle Ford activity still has not substantially increased. Booming sales volume of dry cropland and an absence of irrigated land sales in the Rio Grande Valley may have contributed to the price decline.

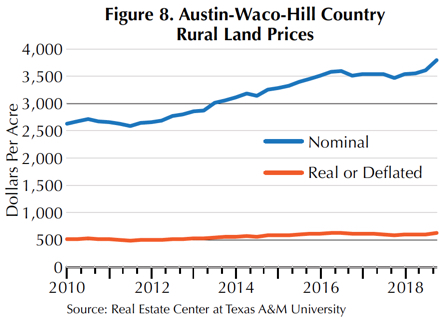

Austin-Waco-Hill Country

The Central Texas market recovery finished 2018 strong with a 9.4 percent price increase to $3,792 per acre (Figure 8). That marked the fourth straight quarter of stable-to-rising prices and the largest percentage increase since 2014. However, sales dropped about 0.5 percent, and total dollar volume receded by 3.1 percent to $329 million. These changes suggest buyers may have returned to higher-priced counties in the fourth quarter.

____________________

Dr. Gilliland ([email protected]) and

Dr. Kiella ([email protected]) are

research economists and Tian Su a research intern with the Real Estate Center at Texas A&M University.

You might also like

Publications

Receive our economic and housing reports and newsletters for free.