Lien on Me

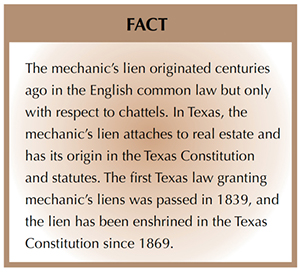

Texas law provides two types of mechanic’s and materialman’s liens—constitutional and statutory—to help ensure tradesmen are paid for work done on real properties. Rules for both are set out in Chapter 53 of the Texas Property Code.

Sometimes the hardest part of business is getting paid. The business of building, repairing, and remodeling real properties is no exception. Quitting the job doesn’t often encourage a property owner to pay, and undoing the work—even if possible—is counterproductive. That’s why Texas law affords tradesmen a method of protecting themselves and collecting for their work. This protection is known as the mechanic’s and materialman’s lien.

What’s a Lien?

A lien is a charge against property to secure payment of a debt or performance of an obligation. It is not title to property, and a lienholder does not have ownership rights. Rather, it is an equitable interest that gives its holder the right to have satisfaction out of the property to secure the payment of a debt. Simply put, a lien on the property is an encumbrance that the property owner must deal with. Like other liens—mortgages and tax liens, for example—a mechanic’s and materialman’s lien could ultimately result in a foreclosure and forced sale of the property to satisfy the lien.

Constitutional and Statutory Mechanic’s Liens

Texas has two types of mechanic’s liens—constitutional and statutory. All Texas mechanic’s liens have their source in Article XVI, Section 37 of the state constitution, which says, “Mechanics, artisans, and material men of every class shall have a lien upon the buildings and articles made or repaired by them for the value of their labor done thereon or material furnished therefor; and the legislature shall provide by law for the speedy and efficient enforcement of said liens.” The legislature fulfilled that constitutional mandate by passing the mechanic’s lien statutes, found in Chapter 53 of the Texas Property Code.

A constitutional lien is self-executing. It arises out of the language of the constitution itself and requires no filing or action on the part of the contractor. However, it applies only to contractors and suppliers in direct contractual privity with the property owner. A subcontractor does not have a constitutional lien.

In addition, contractors and suppliers, including subcontractors, have a statutory mechanic’s lien, which may be perfected (perfection is discussed later in this article) by following the rules set out in Chapter 53. The statutory mechanic’s lien affords substantially more protection in that it protects against subsequent purchasers. Chapter 53 sets out the rules of the statutory lien in great detail. This article addresses the more common situations, but it is not exhaustive.

A person has a lien if he labors or furnishes labor or materials, including specially fabricated materials, for construction or repairs to a house, building, or improvement (Tex. Prop. Code § 53.021). Improvements include, but are not limited to, clearing, draining, or fencing of land; wells, cisterns, tanks, reservoirs, or artificial lakes or pools made for supplying or storing water; pumps, windmills or other machinery used to supply water for stock, domestic use, or irrigation; and planting, pruning, or maintaining orchards (Tex. Prop. Code § 53.001[2]).

A person who specially fabricates material has a lien, even if the material is not delivered (Tex. Prop. Code § 53.021[b]). Material is specially fabricated if it is fabricated for use in the construction or repair so as to be reasonably unsuitable for use elsewhere (Tex. Prop. Code § 53.001[12]).

A person also has a lien for architectural or engineering design services or surveying or for landscaping, dirt work, or demolition services done under or by virtue of a written contract with the owner or the owner’s agent (Tex. Prop. Code § 53.021).

The lien extends to the house, building, fixtures, or improvements. In a city or town, the lien extends to each lot on which the house, building, or improvement is situated or on which the labor was performed. Outside a city or town, the lien extends to up to 50 acres on which the house, building, or improvement is situated or on which the labor was performed. The lien does not extend to abutting sidewalks, streets, and utilities that are public property (Tex. Prop. Code § 53.022).

What is Perfection?

To get the full protection of the lien, the person claiming the lien must perfect the lien in accordance with the statutes. Generally speaking, this means the claimant must:

- give the appropriate preliminary notices,

- make the appropriate filing, and

- give notice to the property owner.

Preliminary Notices

Original contractors do not have to give preliminary notices. However, before a residential construction contract is signed, they must give the disclosure statement required by Tex. Prop. Code § 53.255. Before commencing work, they must provide a list of all subcontractors and suppliers to be used (Tex. Prop. Code § 53.256). Special notices are required for contractual retainage and specially fabricated materials (Tex. Prop. Code §§ 53.057-53.058, 53.252-53.253).

Additionally, if the property is a homestead, a written contract between the original contractor and owner must be filed with the county clerk before any work is done on the homestead. If the owners are a married couple, both spouses must sign (Tex. Prop. Code § 53.254).

When labor or materials are provided and remain unpaid, original contractors are not required to give pre-lien notice to be protected by the constitutional lien. However, they must comply with the affidavit requirements to protect themselves against third parties. Subcontractors and those supplying materials who have a contract with the original contractor are commonly called first-tier subcontractors. For nonresidential property, first-tier subcontractors must send a required notice to the owner, with a copy to the original contractor, by the 15th day of the third month following each month work was performed and unpaid. This is required for perfection of the lien, and it requires the owner to retain funds (Tex. Prop. Code § 53.056[c]). For residential property, the notices must be sent to both the owner and original contractor by the 15th day of the second month, and special language is required if the property is a homestead (Tex. Prop. Code § 53.252). Separate notices are required to perfect liens on contractual retainage claims and specially fabricated materials (Tex. Prop. Code §§ 53.057-53.058, 53.252-53.253). Second-tier and lower parties (subcontractors who contracted with someone other than the original contractor) on nonresidential projects must send notice to the original contractor by the 15th day of the second month after each month labor or materials were provided. If still unpaid, notice must be sent to the owner and original contractor by the 15th day of the third month following each month in which work was performed and unpaid (Tex. Prop. Code § 53.056[b]).

To authorize the owner to retain funds, the notice must state, “If the claim remains unpaid, the owner may be personally liable, and the owner’s property may be subjected to a lien unless: (1) the owner withholds payment from the contractor for payment of the claims; or (2) the claim is otherwise paid or settled” (Tex. Prop. Code § 53.056).

If the property is a homestead, Tex. Prop. Code §53.254(g) says the notice must include the following:

If a subcontractor or supplier who furnishes materials or performs labor for construction of improvements on your property is not paid, your property may be subject to a lien for the unpaid amount if:

(1) after receiving notice of the unpaid claim from the claimant, you fail to withhold payment to your contractor that is sufficient to cover the unpaid claim until the dispute is resolved; or

(2) during construction and for 30 days after completion of construction, you fail to retain 10 percent of the contract price or 10 percent of the value of the work performed by your contractor.

If you have complied with the law regarding the 10 percent retainage and you have withheld payment to the contractor sufficient to cover any written notice of claim and have paid that amount, if any, to the claimant, any lien claim filed on your property by a subcontractor or supplier, other than a person who contracted directly with you, will not be a valid lien on your property. In addition, except for the required 10 percent retainage, you are not liable to a subcontractor or supplier for any amount paid to your contractor before you received written notice of the claim.

Specially fabricated items also have special notice requirements (Tex. Prop. Code § 53.058).

Filing Affidavits

The claimant must file an affidavit with the county clerk in the county where the property is located. The affidavit must contain:

- a sworn statement of the amount of the claim;

- the name and last known address of the owner or reputed owner;

- a general statement of the kind of work done and materials furnished by the claimant and, for a claimant other than an original contractor, a statement of each month in which the work was done and materials furnished for which payment is requested;

- the name and last known address of the person by whom the claimant was employed or to whom the claimant furnished the materials or labor;

- the name and last known address of the original contractor;

- a description, legally sufficient for identification, of the property sought to be charged with the lien;

- the claimant’s name, mailing address, and, if different, physical address; and

- for a claimant other than an original contractor, a statement identifying the date each notice of the claim was sent to the owner and the method by which the notice was sent.

The claimant may attach to the affidavit a copy of any applicable written agreement or contract and a copy of each notice sent to the owner (Tex. Prop. Code Ann. § 53.054).

To be effective against subsequent purchasers and creditors, the contract must contain a property description.

A lien affidavit for homestead property must contain the following notice conspicuously printed, stamped, or typed in a size equal to at least ten-point boldface or computer equivalent at the top of the page: “Notice: THIS IS NOT A LIEN. THIS IS ONLY AN AFFIDAVIT CLAIMING A LIEN” (Tex. Prop. Code § 53.254[f]).

A lien on a homestead requires strict compliance with the requirements of Chapter 53.

For nonresidential property, the affidavit must be filed on or before the 15th day of the fourth calendar month after the day on which the indebtedness accrues. For residential property, the affidavit must be filed on or before the 15th day of the third calendar month after the day on which the indebtedness accrues (Tex. Prop. Code § 53.052).

The day on which the indebtedness accrues for an original contractor is the last day of the month in which either the owner or the original contractor terminates the contract in writing, or the last day of the month in which the original contract is completed, finally settled, or abandoned. For a subcontractor, the indebtedness accrues on the last day of the last month in which the labor was performed or the material furnished (Tex. Prop. Code § 53.053). However, for the subcontractor’s lien to attach to retained funds, the affidavit must be filed within 30 days after the work is completed (Tex. Prop. Code § 53.103).

Notice of Filing

The claimant must give notice of the filing of the affidavit by registered or certified mail within five days after filing to the property owner and the original contractor (Tex. Prop. Code § 53.055). All notices, including the preliminary notices, must be given by registered or certified mail (Tex. Prop. Code §§ 53.055, 53.056).

Nobody’s Perfect

Those requirements can be a lot to handle, so when the contractor has failed to protect itself by perfecting a statutory lien, the constitutional lien can sometimes serve as a backup.

While the statutory lien provides more protection, the lien set out in the constitution is self-executing against the original owner of the property in favor of the original contractor. There are no filing requirements, and no additional action is required.

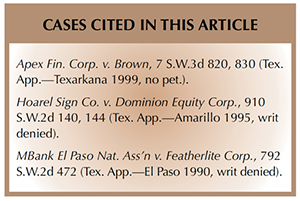

However, the constitutional lien is not self-executing in respect to the liens of derivative claimants (i.e., subcontractors do not have a constitutional lien), and it is not binding on subsequent purchasers of the property who purchase without actual or constructive notice of the constitutional lien (see

Apex Fin. Corp. v. Brown).

Enforcing the Lien

Often, the notice or the filing of the lien affidavit is all that is necessary to resolve the debt on the property. If the debt is paid or settled after the filing of a lien affidavit, the owner should make sure a release is recorded (Tex. Prop. Code § 53.152, 53.157).

In case further collection action is needed, Texas mechanic’s liens may only be enforced by judicial foreclosure (Tex. Prop. Code § 53.154). In other words, a lawsuit has to be filed to force the sale of the property so a lienholder can be paid.

A suit to enforce the lien must be filed within the appropriate time limits. For nonresidential properties, it must be initiated by the later of two years after the last date on which the lien claimant could file a lien, or one year after termination, completion, or abandonment of the work. For residential property, the deadline is the later of one year after the last date on which the lien claimant could file a lien, or one year after termination, completion, or abandonment of the project (Tex. Prop. Code § 53.158). Constitutional liens may be enforced up to four years from when the debt accrued (see

Hoarel Sign Co. v. Dominion Equity Corp.).

Which Lien Has Priority?

Generally, mechanic’s liens have priority over all other liens not attached prior to the inception of the mechanic’s lien (Tex. Prop. Code § 53.123; also see MBank El Paso Nat. Ass’n v. Featherlite Corp.). Subcontractors, laborers, and materialmen with mechanics’ liens have preference over other creditors of the original contractor (Tex. Prop. Code § 53.121) and are on equal footing with each other, regardless of the filing date of the lien affidavits (Tex. Prop. Code § 53.122). Special priority rules exist for architects, engineers, surveyors, landscapers, and demolition workers.

This overview of mechanic’s lien law does not cover all details of the law. Mechanic’s lien law is highly technical and contains many traps for the unwary. For specific advice, consult an attorney who is familiar with the rules.

____________________

Adams ([email protected]) is a member of the State Bar of Texas and a research attorney for the Real Estate Center at Texas A&M University.

You might also like

Publications

Receive our economic and housing reports and newsletters for free.