Keep Austin Affordable

In 1986, the Low-Income Housing Tax Credit program was initiated by the federal government to encourage more affordable housing across the U.S. During that time, the program has made possible the addition of over 9,400 affordable multifamily units in Travis County. More than half of those have been built since 2013. |

Note: This article focuses only on newly constructed multifamily LIHTC projects in Travis County that have been awarded a 9 percent tax credit.

Supplying adequate, affordable housing for low-income residents is a constant challenge for both the public and private sectors. Challenges are often tied to financing, regulatory, or policy limitations. Numerous federal government programs have been created to address the problem, employing a variety of subsidies and incentives.

The Low-Income Housing Tax Credit (LIHTC) program, established in 1986, is one such program. Geared specifically to the production of affordable rental units, LIHTC encourages their development through federal income tax credits and incentives.

The LIHTC program currently gives out in excess of $9 billion in federal income tax credits annually to support the development of more than 100,000 affordable rental housing units each year. According to the Department of Housing and Urban Development (HUD), the program is the most important resource for creating affordable housing in the U.S. today. Since its inception, the LIHTC program has produced more than three million affordable units.

The program continues to receive strong support from developers and investors as well as bipartisan support from Congress. However, it is not without its critics. A great deal has been published discussing the program’s methods. Siting affordable housing in higher versus lower-opportunity neighborhoods is just one example. But rather than discussing the program’s controversies and limitations, this article assesses its impact by showcasing census tracts in Travis County that have LIHTC multifamily developments. This analysis will act as a pilot program for the examination of other areas around the state where LIHTC properties have been located.

How the Program Works

The tax credit program is funded by the U.S. Treasury Department and overseen by the Internal Revenue Service (IRS). However, it is administered at the state level. In Texas, that falls to the Texas Department of Housing and Community Affairs (TDHCA). Each state receives a fixed allocation of tax credits annually based on its population.

Private for-profit and nonprofit housing developers are eligible to apply. The tax credits are awarded to eligible investors to offset a portion of their federal tax liability in exchange for the production or preservation of affordable rental housing. The result is the creation of “affordable" units that will be leased to qualified households at below-market rents. LIHTC projects must pass an affordability test to qualify for tax credits. They can do this in one of three ways:

- At least 20 percent of the project’s units must be occupied by tenants with incomes of 50 percent or less of the area median income (AMI) adjusted for family size.

- At least 40 percent must be occupied by tenants with incomes of 60 percent or less of AMI.

- At least 40 percent must be occupied by tenants with incomes averaging 60 percent or less of AMI

and no units are occupied by tenants with income greater than 80 percent of AMI.

Applications for the credits are based on each state’s Qualified Allocation Plan (QAP). States establish their specific housing priorities and goals in the QAP. The scoring process laid out in the QAP incentivizes developers to deliver projects that address the state’s affordable housing objectives. Tax credits are available for new construction or the rehabilitation of existing LIHTC properties. Not all units must be leased to low-income tenants at affordable rates, but most winning projects are heavily weighted toward affordable units.

Two types of tax credits are available. The first is a 9 percent credit awarded to developers on a competitive basis. The second type is a 4 percent credit awarded on a noncompetitive basis to developers who use tax-exempt bonds as part of their financing. Four percent credits are available statewide and not regionally allocated.

TDHCA’s Regional Allocation Formula (RAF) determines the number of 9 percent tax credits available in each of 13 Texas regions (Map 1). Each of those regions has a subcategory where areas are designated as either urban or rural. This means credits are allocated to 26 different regions of the state.

Texas carves out three specific set-asides for “at-risk" properties, developments that receive assistance from the U.S. Department of Agriculture, and projects sponsored by nonprofits. At-risk properties are LIHTC developments coming to the end of their 30-year affordable-unit mandate. At least 10 percent of tax credit allocations must be awarded to nonprofits.

Applications are scored and ranked within their particular region or set-aside. Scoring criteria are based on a large number of factors such as financial feasibility, local government and nonprofit support for projects, amenities, and nearby services available to tenants.

LIHTC projects must maintain the percentage of affordable units specified in a Land Use Restriction Agreement (LURA) for a 15-year initial “compliance period" plus another 15-year “extended-use period." TDHCA offers extra points for keeping units in the affordable category longer than the 30-year minimum requirement.

Tax credits are subject to recapture by the IRS in the first 15 years if units are shifted from affordable to market rates. The credits are distributed to investors in equal amounts over a ten-year period.

Investors purchase tax credits in exchange for equity in the LIHTC project. Investments can be made directly to one specific project or through a syndicator who pools investor money and spreads it across several projects. In this way, the investor is exposed to less financial risk.

Credits are generally purchased by investors at a discount. However, they may pay more than one dollar for a dollar’s worth of credits if other beneficial tax deductions such as depreciation, interest expense, or net operating losses come into play.

For example, if a project is in a HUD-defined difficult development area (DDA) or a qualified census tract (QCT), the eligible basis of the project for depreciation purposes can be increased by 30 percent. DDAs are locations that have relatively high construction, land, and utility costs. QCTs are areas with a poverty rate of at least 25 percent, or tracts where 50 percent of the households have incomes below 60 percent of the area’s median income. Affordable housing advocates remain divided regarding the siting of units in areas of high poverty.

In Texas, the TDHCA is responsible for monitoring the development and operation of approved projects. TDHCA will notify the IRS of noncompliance if the project deviates from the requirements specified in the tax code and the LURA. An investor typically stays in the partnership for at least the 15-year compliance period to prevent the IRS from recapturing the tax credits.

Impact of LIHTC Units in Travis County

Tax credits are not disbursed until the “credit allocation year," the year the project is both completed and occupied. According to HUD’s LIHTC database, 63 new multifamily LIHTC projects with five or more units received tax credit allocations in Travis County from 1987 to 2018. The projects have a combined 9,924 units, of which 9,438 are affordable. An additional 99 projects categorized as “Acquisition and Rehab" or “Information Not Available" collectively add 11,452 total units. Just over 6,700 of those are for low-income families.

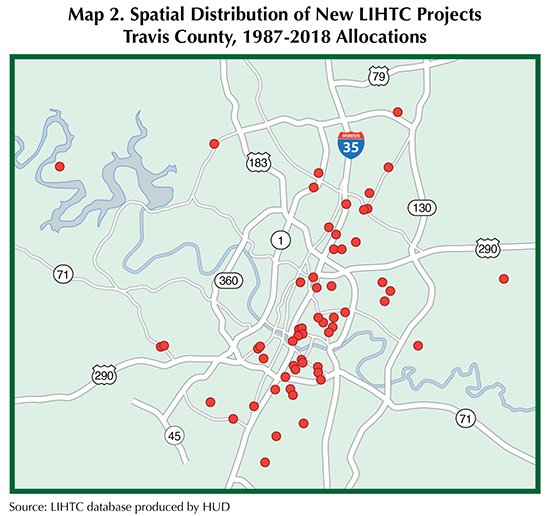

Map 2 shows the spatial distribution of new LIHTC projects in Travis County that received tax credit allocations between 1987 and 2018. Unsurprisingly, projects are heavily clustered on the east side of I-35 where land has historically been more affordable.

Nearly half of all new LIHTC projects have been allocated tax credits since 2013 (Map 3). From 2013 to 2018, 30 received credit allocations, compared with ten between 1987 and 1993, nine between 1994 and 1999, and 14 between 2000 and 2005. The higher proportion of LIHTC units receiving allocations between 2013 and 2018 may be partially due to the absence of new projects between 2006 and 2012 (a period that includes the Great Recession).

The 30 projects since 2013 have added 5,142 low-income units, more than half of the total stock of new affordable LIHTC units sited in Travis County since the program’s inception. Until a further analysis is conducted, it is unknown whether the increase is restricted to Travis County or an overall increase in new-construction LIHTC projects statewide.

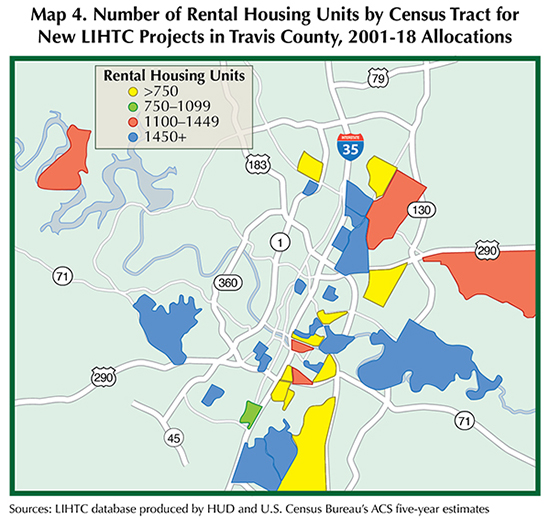

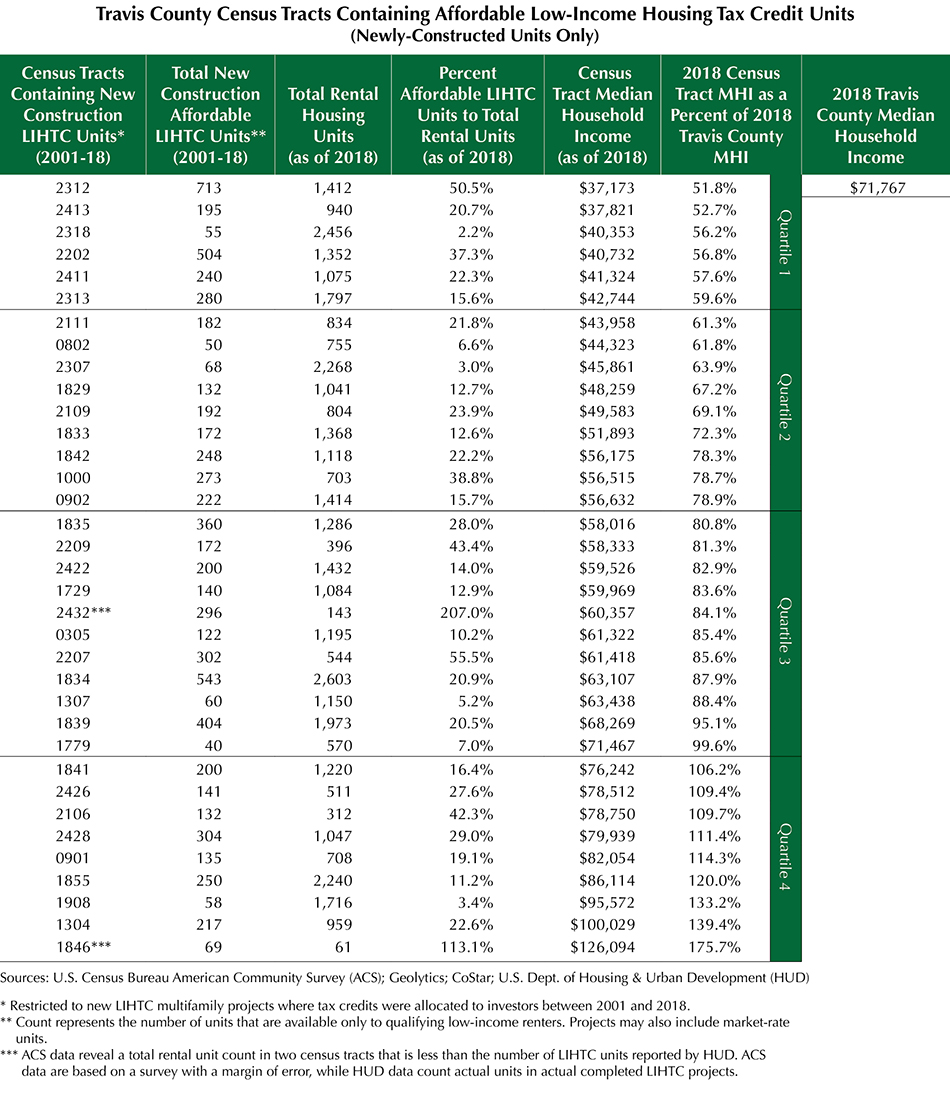

Maps 4 and 5 along with the table show only the 35 census tracts in Travis County with new-construction LIHTC projects allocating credits to investors between 2001 and 2018. Although the LIHTC program began in 1986, U.S. Census data for the number of total rental units and median household income (MHI) are available only at the census tract level from the 2000 decennial census forward. Data for new LIHTC projects receiving allocations from 2001 to 2005 were obtained from Geolytics, while data for 2013 projects forward were obtained from the U.S. Census Bureau’s American Community Survey (ACS).

Again, the concentration of all rental housing is heaviest along the east side of I-35 (Map 4). The lower number of rental properties on the far east side of the county may be due to the lack of transportation infrastructure in the area.

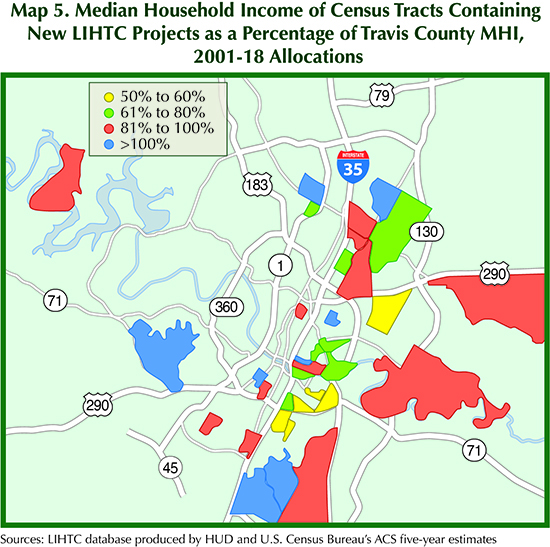

Map 5 shows the 2018 MHI of each census tract containing new LIHTC projects as a percentage of the 2018 Travis County MHI. The map clearly shows that not all LIHTC units are confined to poorer areas with low household incomes. MHIs by census tract range from $37,173 to $126,094, which is 51.8 percent to 175.7 percent of Travis County’s $71,767 MHI (see table).

The MHI in nine of the 35 census tracts surpasses the MHI of Travis County overall. These tracts (quartile 4) contain 19.6 percent of affordable LIHTC units receiving tax credits since 2001. Census tracts in quartiles 1, 2, and 3 (representing 50-60 percent, 61-80 percent, and 81-100 percent of Travis County MHI) contain the remaining 25.9 percent, 20.1 percent, and 34.4 percent of affordable LIHTC units, respectively.

The percentage of affordable LIHTC units to total rental units in the 35 census tracts ranges from 2.2 to 55.5 percent. Two tracts show more affordable LIHTC units than total rental units. This may be due to problems with ACS data. The number of LIHTC units is known with certainty while total rental units are based on surveys conducted with local residents. The surveys are published with a margin of error, indicating actual numbers may vary.

The LIHTC program has made 16,143 affordable multifamily units available to low-income households in Travis County when acquisition/rehab units and units with no available information are included. The impact is a relatively small 3.2 percent of all rental units in Travis County. Just the new affordable LIHTC units are a mere 1.8 percent.

Although most units have been located east of I-35, projects have been fairly evenly disbursed geographically across the county. Furthermore, 20 of the 35 census tracts have MHIs that are 80 percent or more of the Travis County MHI.

The LIHTC program is not the miracle cure for the affordable housing problem, but it has had a positive impact on the supply of affordable housing in Travis County.

____________________

Dr. Hunt ([email protected]) is a research economist and Losey a research intern with the Real Estate Center at Texas A&M University.

You might also like

Publications

Receive our economic and housing reports and newsletters for free.