In Short Supply

A shortage of homes, particularly in the lower price ranges, has constrained affordability, especially for lower-income households. The financial pressures the pandemic has imposed on these households have further diminished their homebuying potential. |

COVID-19’s effects on the nation’s labor market have bled over into the housing market, impacting not only current homeowners, but potential buyers as well.

According to the Congressional Research Service, young workers, women, workers with low educational attainment, part-time workers, and racial and ethnic minorities were hit especially hard by the pandemic. Workers in industries that provide in-person services have also faced disparately high unemployment rates. As a result, their home-purchasing power has likely been diminished despite historically low mortgage interest rates. These groups comprise a significant share of traditional first-time buyers seeking affordable homes.

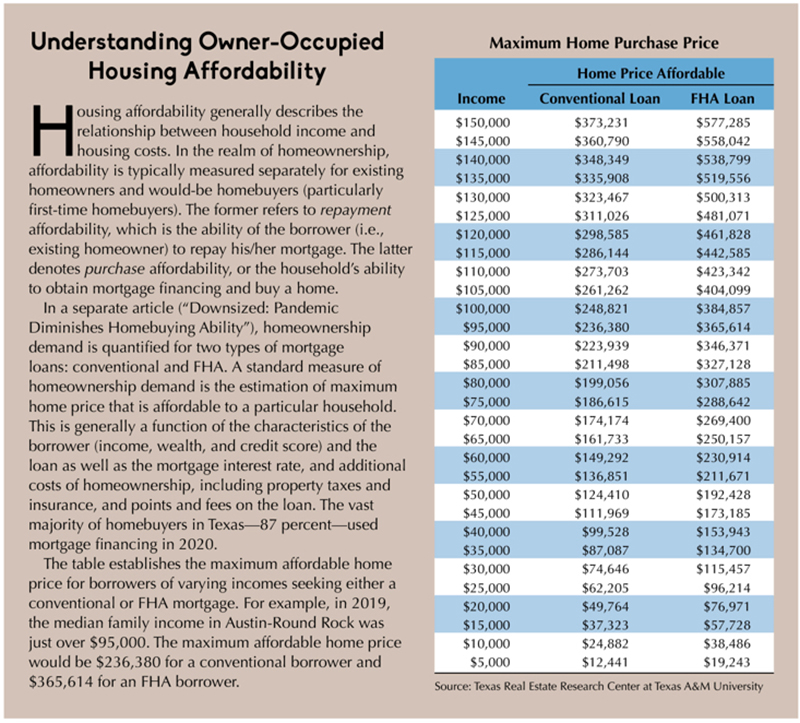

Most assessments of owner-occupied housing affordability focus singularly on estimating the demand for homeownership. For instance, the Housing Affordability Index produced by the National Association of Realtors measures the ability of a family earning the median income to afford the median-priced home with a conventional loan. However, by failing to consider the

availability of housing in the buyer’s price range, it offers an incomplete assessment of purchase affordability. Without the availability of affordable homes, demand matters little.

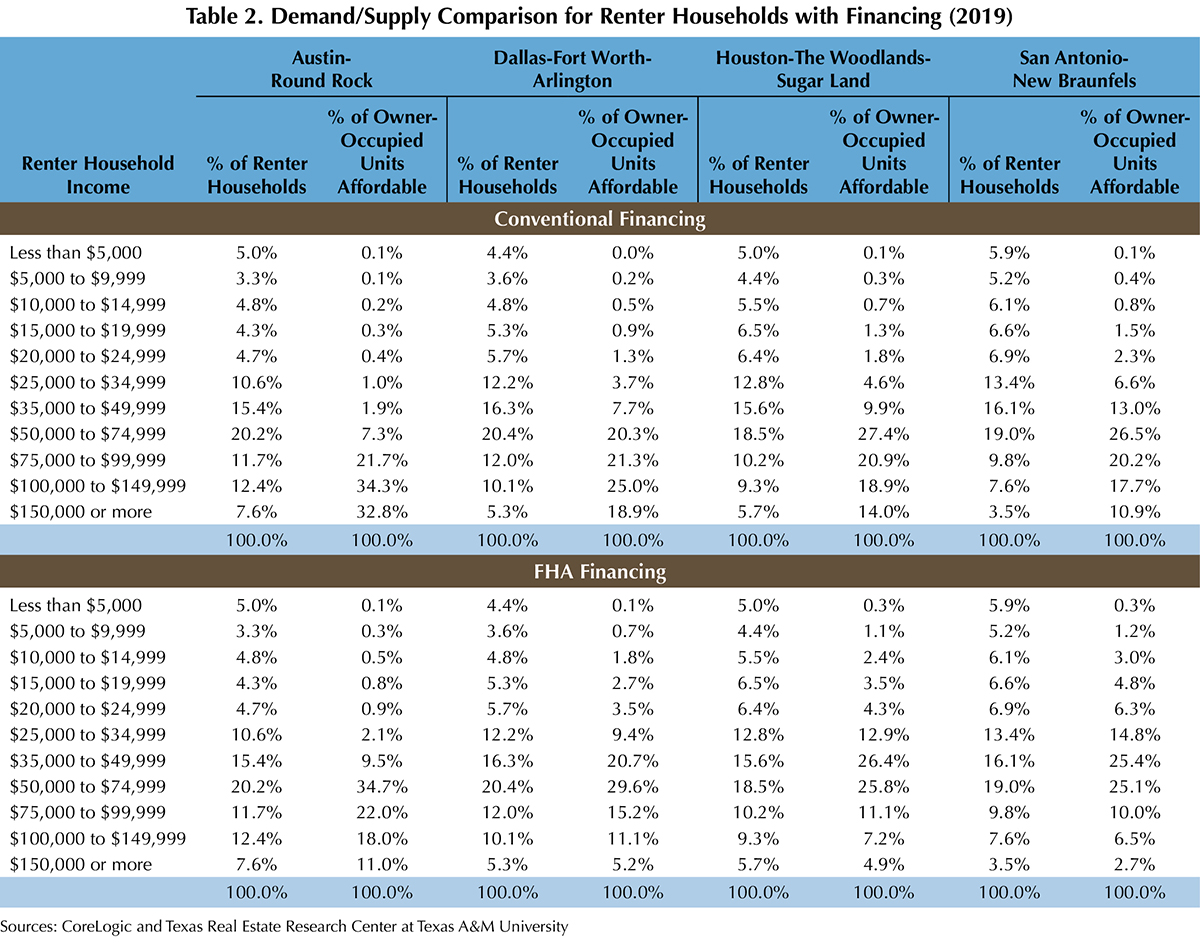

For this study, American Community Survey data were used to measure the proportion of renter households in each income category in Texas’ major Metropolitan Statistical Areas (MSAs). CoreLogic appraisal data, combined with estimates of the maximum home price affordable to households by income and loan type (conventional or Federal Housing Administration [FHA]), were used to quantify the supply of homes affordable to each income category. This analysis presents several limitations. CoreLogic data reflect the total supply of homes within each “price" range (where prices reflect appraisal district values), rather than the number of homes actually for sale within each price range (Table 1). Likewise, the demand figures reflect the total number of renter households in each income cohort (Table 2), as opposed to only those households looking to become homeowners. All data reflect 2019 figures; 2020 Census data will not be published until late 2021.

Results Reveal Shortages

Subject to these limitations, the under or oversupply of homes that renter households would have had sufficient income to purchase in 2019 in Texas’ major MSAs is shown in Table 3. Numbers are shown for both conventional and FHA financing. For example, in Austin-Round Rock, there was a shortage of 66,394 homes for renter households earning $35,000-$49,999 who were using conventional financing. For similar households using FHA financing, there was a shortage of 29,044 homes.

Several patterns are evident. The most prominent shows that, across all four MSAs, the shortage of homes is much more pronounced among lower-income households with conventional loans rather than FHA loans. Government-sponsored mortgages generally offer more relaxed borrowing constraints than conventional mortgages (FHA loans do not require the same wealth and income—loan-to-value and debt-to-income ratios—as conventional loans). Furthermore, regardless of the type of loan, affordability is most constrained for lowest-income households, particularly those earning less than $50,000 annually. First-time buyers, who tend to be younger than repeat buyers, are more likely to fall in the lower-income cohorts.

Several patterns are evident. The most prominent shows that, across all four MSAs, the shortage of homes is much more pronounced among lower-income households with conventional loans rather than FHA loans. Government-sponsored mortgages generally offer more relaxed borrowing constraints than conventional mortgages (FHA loans do not require the same wealth and income—loan-to-value and debt-to-income ratios—as conventional loans). Furthermore, regardless of the type of loan, affordability is most constrained for lowest-income households, particularly those earning less than $50,000 annually. First-time buyers, who tend to be younger than repeat buyers, are more likely to fall in the lower-income cohorts.

The table shows homeownership is generally out of reach for the lowest-income cohorts. The supply of homes in their price range is simply insufficient. FHA’s more relaxed qualifying standards certainly enhance purchase affordability, but FHA financing generally remains unattainable for the lowest-income buyers, who lack both income and wealth (even without considering potential credit constraints).

Shortages in homes for highest-income households using FHA financing cause these households to “buy down." In other words, they purchase homes that are priced lower than what is reasonably affordable to them. Consequently, they dip into the supply that is affordable to moderate and high-income cohorts.

Pandemic Puts on the Pressure

Texas’ housing market already faced a variety of challenges before the pandemic, including supply constraints and a decline in purchase affordability following the Great Recession. In 2019, the months of inventory—the supply of homes listed for sale relative to the number of homes purchased—measured a mere three months for the state. Generally, 6.5 months indicates a balanced market—that is, sufficient supply to meet household demand.

Supply is typically more constrained in larger markets because of strong population growth and greater shortages of developable land. Meanwhile, the widening gap between household income and home prices generally signals increased difficulty in meeting the qualifying standards for mortgage financing, particularly for households on the margin.

Assuming it takes longer for low-income and minority households to recover economically, purchasing a home may prove difficult for first-time buyers as they strive to recover lost wages.

However, the government could relax qualifying standards for mortgages insured or guaranteed by federal entities. Furthermore, a potential swath of foreclosures could actually enhance purchase affordability for lower-income households. That will depend on the duration of the foreclosure moratorium and the speed of households’ economic recovery.

For more on how the pandemic has made it more difficult for some Texas households to purchase a home, read “Downsized: Pandemic Diminishes Homebuying Ability."

____________________

Dr. Hunt ([email protected]) is a research economist and Losey a research intern with the Texas Real Estate Research Center at Texas A&M University.

You might also like

Publications

Receive our economic and housing reports and newsletters for free.