How Higher Interest Rates Affect Homebuying

Mortgage interest rates are expected to rise in 2022, making it harder for households—especially first-time homebuyers and low-income households—to purchase a home. |

Mortgage interest rates play an integral role in one’s ability to buy a home. While home-price appreciation averaged nearly 20 percent nationally in 2021, diminishing many households’ ability to purchase a home, mortgage interest rates reached a record low 2.65 percent. This helped mitigate the impact of high appreciation rates.

In response to rising inflation, the Federal Reserve could raise the federal funds rate as many as seven times in 2022. One potential by-product of this is higher mortgage interest rates.

At the beginning of the year, economists projected mortgage interest rates would be between 3.5 and 4 percent by the end of 2022 (after hovering around 3 percent at the beginning of 2022). However, forecasts will likely be revised upward in response to the news of seven potential rate hikes. Such an increase will diminish purchase affordability, making it even more difficult for lower-income and first-time buyers to purchase a home.

Rising Interest Rates and Repeat Buyers

Table 1 shows how much the total monthly mortgage payment for a conventional loan increases as the mortgage interest rate increases. For example, a $200,000 home has a total monthly mortgage payment of $1,299 with a 2.5 percent interest rate. A 4 percent interest rate increases that amount by more than $100 to $1,431.

Changes in that rate can significantly change the amount of income required to qualify for a loan. For a conventional loan on a $200,000 home with a 2.5 percent interest rate, a household would need to earn $51,954 annually with a 30 percent debt-to-income ratio (Table 2). A 4 percent interest rate would increase that amount to $57,221. As the income required to qualify for a loan increases, the maximum home price affordable to that household decreases.

An increase in the interest rate also causes a household’s maximum affordable home price to drop. The home price-to-income multiplier by mortgage interest rate is shown in Table 3. This multiplier reflects how much home a particular household can afford. For a conventional loan, the multiplier is 3.85 for a 2.5 percent interest rate. That means a household can afford a home priced at 3.85 times the household’s income. The multiplier drops to 3.5 for a 4 percent interest rate, a 10 percent decline in home-buying potential.

The percentage of households that earn the required income to qualify for a conventional loan for the same priced home declines as the mortgage interest rate increases. In 2020, over 60 percent of Texas households earned the required income to qualify for a conventional loan for a $200,000 house at a 2.5 percent interest rate, but that dropped to 56.7 percent when the interest rate increased to 4 percent (Table 4).

Rising Interest Rates and First-Time Buyers

Mortgage payments for federally backed loans are no different than payments for conventional loans when it comes to rising mortgage interest rates. For example, a $200,000 home has a total monthly mortgage payment of $1,426 with a 2.5 percent mortgage interest rate, but a 4 percent interest rate increases that amount by more than $100 to $1,579 (Table 5).

Again, as with conventional loans, the income required to qualify for a federally backed loan changes along with the mortgage interest rate. To qualify for a federally backed loan for a $200,000 home with a 2.5 percent interest rate, a household would need an annual income of $71,733 (Table 6). A 4 percent interest rate increases that to $76,984. As with conventional loans, the maximum home price affordable to a household decreases as the income required to qualify for a loan increases.

An increase in the interest rate also causes a household’s maximum affordable home price to drop (Table 7). For a federally backed loan, the home price-to-income multiplier is 2.79 for a 2.5 percent interest rate. That means a household can afford a home priced at 2.79 times the household’s income. The multiplier drops to 2.6 for a 4 percent interest rate, a nearly 7 percent decline.

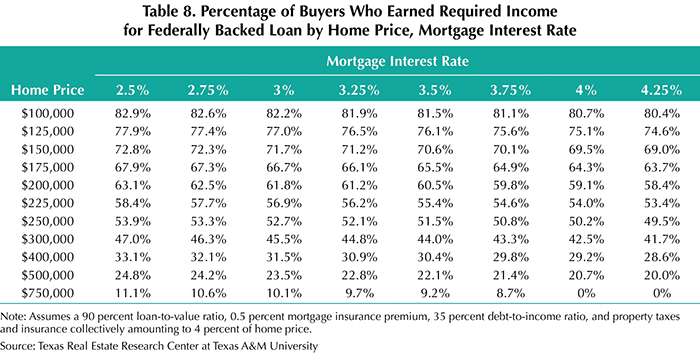

The percentage of households that earn the required income to qualify for a federally backed loan for the same priced home declines as the mortgage interest rate increases. In 2020, over 63 percent of Texas households earned the required income to qualify for a federally backed loan for a $200,000 house at a 2.5 percent interest rate, but that dropped to 59 percent when the interest rate increased to 4 percent (Table 8).

2022 Homebuyer Outlook

With mortgage interest rates expected to rise in 2022, home-purchasing affordability will diminish.

Repeat buyers could see an estimated 3.3 to 6.6 percent decline in home-purchasing potential. For first-time buyers, it could be a 2.3 to 4.6 percent decline.

The bottom line: Homeownership will become harder to attain for households across the income spectrum.

____________________

Dr. Losey ([email protected]) is an assistant research economist with the Texas Real Estate Research Center at Texas A&M University.

You might also like

Publications

Receive our economic and housing reports and newsletters for free.