Home Front

The Takeaway Because active-duty military are generally more active in Texas’ rental market than homebuying market, rental activity is more likely to suffer when troop counts decline. Meanwhile, veterans can be a stabilizing force in some housing markets. |

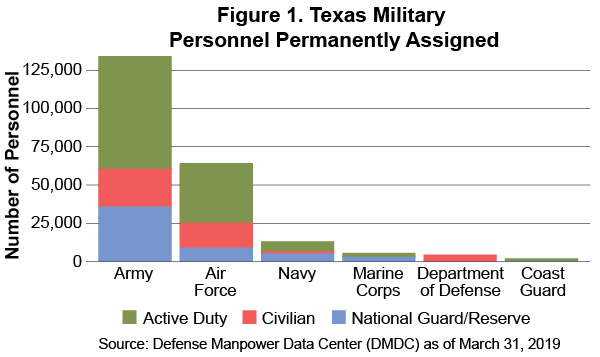

Texas has a large military community that comprises active-duty service members, reservists, national guardsmen, and veterans, among others. It has the third-largest count of permanently assigned military personnel in the nation, trailing only California and Virginia. The vast majority of personnel comes from the Army and the Air Force (Figure 1).

The military’s economic contribution is significant. In 2017, the statewide economic impact from activity affiliated with military installations was at least $101 billion, according to the Texas Comptroller. The level of personnel affects the housing needs in many Texas housing markets.

Declining Military Personnel

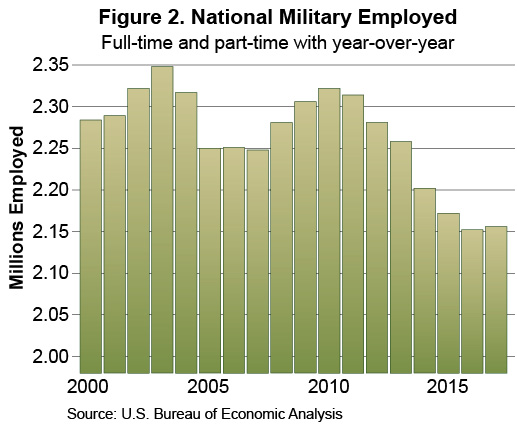

The U.S. military has shrunk significantly since the start of the decade (Figure 2). This trend includes both full-time (active duty) and part-time (reservists) and impacts potential local housing demand by staff military.

Several Texas military installations have had declines in military personnel. This decline has not necessarily meant bad news for the surrounding housing markets, though. In fact, some cities containing large military installations have done well in terms of home sales despite drops in military personnel.

One big reason for this is the workforce composition of the military installation itself. Data collected by the Comptroller group employees as either military or civilian. At one extreme, bases such as Fort Hood and Fort Bliss employ at least 80 percent of their full-time personnel from active-duty service members while the remaining portion comes from civilians (Table 1). The split is nearly 50/50 for Joint Base San Antonio (JBSA), while at the opposite extreme the Army depots in Corpus Christi and Texarkana are both nearly 100 percent staffed by civilians. As will be discussed later, the military has a significantly different buyer profile than the public.

The active-duty employment base in some major Texas cities has diminished in proportion to other emerging employment sectors. For example, take San Antonio, officially known as “Military City, USA" as of 2017. Within the city, JBSA directly employs around 24,000 service members. However, the armed forces’ contribution to the total employment in Bexar County is only around 1 percent and has been in steady decline. There has been a decreasing dependence on the military as other industries either move to or grow in San Antonio.

Active-Duty Inclined to Rent

Generally speaking, active-duty service members are not engaged in the overall homebuying market by both total count and population participation rate. They are more likely to be renters. This includes both privatized military housing and the general rental market.

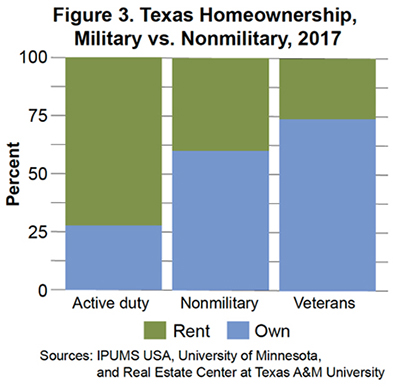

According to the U.S. Census Bureau, the proportion of homeowners among Texas’ active-duty population is considerably lower than that of the nonmilitary population (Figure 3). There are several reasons for this.

First, there is the mobile lifestyle of the typical service member. A change of station or even deployment for many service members is always a possibility. Committing to a property, which is typically a mid- to long-term investment, may simply not be practical. Even service members who know where they want to end up may find acquiring, financing, and maintaining a home to be challenging.

Second, active-duty service members are typically young, single, and often live in military housing, including barracks. Even nonmilitary millennials put off buying homes because of lower net worth, the desire for mobility, or both.

Finally, for those in the military who are able to buy homes, there is still the reality that Texas home prices have risen considerably over the past ten years making homeownership more expensive. In addition, overall income growth in Texas has lagged considerably compared with home-price growth, the leading driver of declining home affordability.

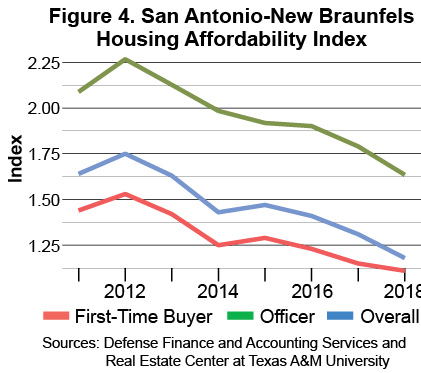

Amending the Texas Housing Affordability Index (THAI) provides a simple comparison of purchasing power between the public and active-duty military. Swapping out overall median income with an officer’s compensation provides a side-by-side comparison of home affordability trends. Looking back to San Antonio in 2013, a captain in the Air Force with at least four years of service and dependents would have had more than twice the income required to qualify for a median-priced home (Figure 4). Meanwhile, the public would have had an overage of 63 percent.

Fast forward to 2018 when a captain under the same assumptions would have had around 63 percent more than the required income in the San Antonio market while the public would be closer to 18 percent. The THAI for the military officer fell from 2.13 in 2013 to 1.63 in 2018, a 23 percent drop. Officers fared better than the public, which lost almost 27 percent on the THAI over the same five years. This means the officer’s income was more robust than most incomes in keeping up with housing price growth during that period.

Officers, however, are the numeric minority with a considerable pay gap compared with enlisted service members. At any given time, there are typically four or five enlisted service-members for every officer in the military according to raw personnel counts from the Defense Manpower Data Center. This further fragments the number of military personnel able to buy a home.

In 2019, the Consumer Finance Protection Bureau (CFPB) reported that the national proportion of first-time homebuyers fell immediately after the Great Recession but began to recover between 2012 and 2016, the end of the study period. According to CFPB’s study, this same recovery did not happen for first-time homebuyers who were in active-duty status.

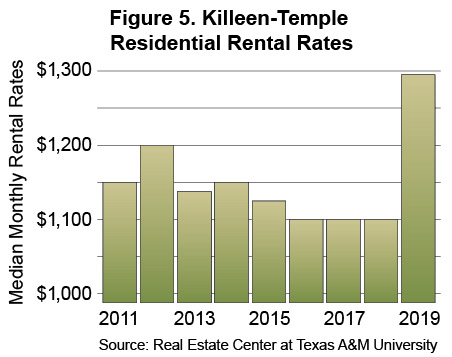

When it comes to housing, active-duty members probably exert their biggest influence on the rental market, where they’re most active. This certainly appears to be the case near Fort Hood in recent years. Residential home prices in the Killeen-Temple Metropolitan Statistical Area began to grow again in 2014 after several flat years. Meanwhile, residential rent growth, both per month and per square foot, remained flat (Figure 5). At this time, Army personnel counts throughout Texas, including at Fort Hood, declined.

Even on-base privatized housing performed poorly during much of this time with stagnant rent growth and low occupancy. According to the Fort Hood Sentinel, in 2016 occupancy got so low Fort Hood authorized civilians to live on the installation.

Veterans Strengthen Housing Market

Military veterans, broadly defined as all who have served in active duty, are another key segment for Texas’ many military housing markets. Unlike their active-duty counterparts, veterans have exceptionally high homeownership rates—higher, even, than the public (Figure 3).

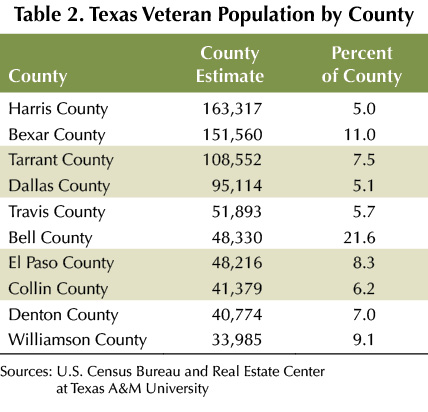

Texas veterans live throughout the state, including in major metro areas, but they often choose to live in communities near major military installations. Bell, Bexar, and El Paso Counties all have exceptionally high veteran population estimates (Table 2).

Veterans make up more than 20 percent of Bell County’s population over the age of 18, the highest in the state. Many other counties with the highest veteran populations are near Bell and Bexar Counties, spilling over into surrounding communities.

Due to their population size and high homeownership rate, veterans can have a strong impact on an area’s housing market. This may help explain why some housing markets, like the one including Fort Hood, continued growing despite diminishing active troop counts or other downturns.

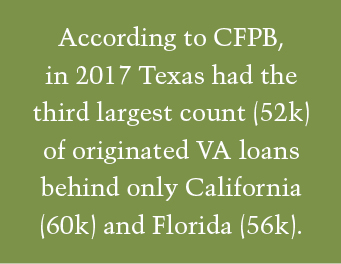

For example, veteran housing demand was strong even during the ups and downs of the past ten years. According to loan origination data for primary residence purchases, VA loan activity avoided much of the fallout from the mortgage crisis, unlike activity for conventional loans.

One of the most influential drivers behind loan demand could be the more restrictive loan-to-value requirements adopted by conventional loans after the financial crisis. This is likely given the drastic rise in FHA loans originated in the late 2000s (Figure 6). Both FHA and VA finance at or near 100 percent of the home’s value.

Robust demand from veterans played a major role in housing market growth in Killeen-Temple, near Fort Hood. For much of the decade, approximately half the purchase loan demand came from veterans through VA loans. Used as a proxy for general housing demand, veteran contribution to home sales may actually be higher assuming some veterans elected other loan options or paid in cash. It’s clear that this segment can provide a stabilizing force in some local housing markets.

____________________

Roberson ([email protected]) is a senior data analyst with the Real Estate Center at Texas A&M University.

You might also like

Publications

Receive our economic and housing reports and newsletters for free.