Down to Earth

You might also like

TG Magazine

Check out the latest issue of our flagship publication.

Helping Texans make the best real estate decisions since 1971.

As the state’s population grows, so does the need for more housing. Here are the data and tools you need to keep up with housing market trends in your area.

Whether you’re talking about DFW’s financial services industry, Austin’s tech sector, Houston’s energy corridor, or the medical hub that is San Antonio, commercial real estate is big business in Texas.

Mineral rights. Water issues. Wildlife management and conservation. Eminent domain. The number of factors driving Texas land markets is as big as the state itself. Here’s information that can help.

Texas is a large, diversified state boasting one of the biggest economies in the world. Our reports and articles help you understand why.

Center research is fueled by accurate, high-quality, up-to-date data acquired from such sources as Texas MLSs, the U.S. Bureau of Labor Statistics, and the U.S. Census Bureau. Data and reports included here are free.

Stay current on the latest happenings around the Center and the state with our news releases, NewsTalk Texas online searchable news database, and more.

We offer a number of educational opportunities throughout the year, including our popular Outlook for Texas Land Markets conference. Check here for updates.

Established in 1971, the Texas Real Estate Research Center is the nation’s largest publicly funded organization devoted to real estate research. Learn more about our history here and meet our team.

Despite continuing turmoil in worldwide oil markets, Texas’ statewide land markets managed to post a small gain in prices in second quarter 2016, moving up 2.25 percent to $2,544 per acre from the 2015 second quarter price of $2,460 per acre.

Despite continuing turmoil in worldwide oil markets, Texas’ statewide land markets managed to post a small gain in prices in second quarter 2016, moving up 2.25 percent to $2,544 per acre from the 2015 second quarter price of $2,460 per acre.

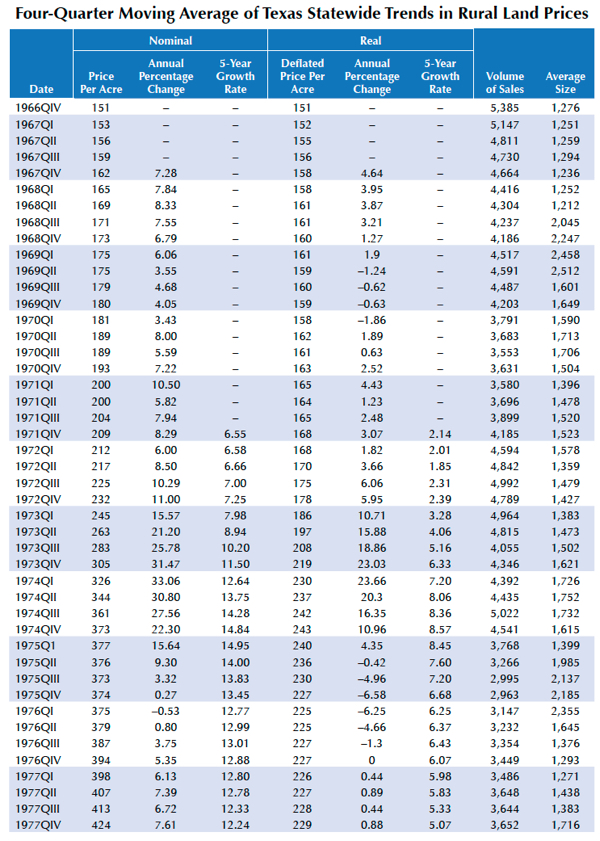

Despite the increase, price per acre inched up only 2.37 percent from the 2016 first quarter price. The typical size of properties statewide closed at 1,116 acres, down 76 acres from second quarter 2015 acreage. The 4,963 sales increased by 18 sales over 2015 second quarter volume. Total dollar volume of sales at $796 million fell short of the 2015 third quarter total of $910 million. Real price settled at $444 per acre (in 1966 dollars), setting another record high real prices (see table and Figures 1–3).

Weak performances in Far West Texas, Gulf Coast–Brazos Bottom, and South Texas reflected downward market pressures from energy price declines. Nevertheless, annualized price increases in the Panhandle and South Plains, Northeast Texas, and Austin–Waco–Hill Country regions offset results in regions with price declines. The number of transactions declined across the board, pointing to possible emerging caution among buyers at current prices.

Adding to the cautionary negative regional price trends, the volume of sales retreated for at least two straight quarters statewide. This pullback suggests potential buyers may be cooling to land purchases at current prices. Weak energy prices coupled with low commodity prices threaten the general prosperity of much of the region.

Studies of Texas land markets indicate oil prices and total Texas personal income have a long-term impact on land markets. Total personal income captures both growth in population and increases in individual incomes. In the shortrun, both these factors have little impact on either land prices or the total number of acres traded. However, over a ten-year period, a 10 percent jump in Texas personal income will boost land prices by nearly 4 percent; a 10 percent bump in oil prices inspires a corresponding 2.5 percent increase in land prices.

These two variables also have an impact on the total number of acres trading in the market but in different directions. Specifically, a 10 percent expansion in Texas personal income delivers a long-term, 2 percent increase in total acreage sold. However, a 10 percent increase in oil prices produces a 2 percent decline in total acreage transferred.

A ten percent increase in Texas personal income incites nearly a 6 percent boost in the total dollar volume of transactions in Texas markets, while oil price changes have only a small impact, less than 1 percent for a 10 percent swing. This suggests Texas land market participants have a long memory of past price trends and a reluctance to quickly adjust to changing circumstances. The estimates also suggest that growing total personal income may outweigh the drop in oil prices when it comes to determining prices and volume in Texas land markets.

____________________

Dr. Gilliland ([email protected]) is a research economist and Su and Watson are research assistants with the Real Estate Center at Texas A&M University.

Receive our economic and housing reports and newsletters for free.

As the state’s population grows, so does the need for more housing. Here are the data and tools you need to keep up with housing market trends in your area.

Whether you’re talking about DFW’s financial services industry, Austin’s tech sector, Houston’s energy corridor, or the medical hub that is San Antonio, commercial real estate is big business in Texas.

Mineral rights. Water issues. Wildlife management and conservation. Eminent domain. The number of factors driving Texas land markets is as big as the state itself. Here’s information that can help.

Texas is a large, diversified state boasting one of the biggest economies in the world. Our reports and articles help you understand why.

Center research is fueled by accurate, high-quality, up-to-date data acquired from such sources as Texas MLSs, the U.S. Bureau of Labor Statistics, and the U.S. Census Bureau. Data and reports included here are free.

Stay current on the latest happenings around the Center and the state with our news releases, NewsTalk Texas online searchable news database, and more.

We offer a number of educational opportunities throughout the year, including our popular Outlook for Texas Land Markets conference. Check here for updates.

Established in 1971, the Texas Real Estate Research Center is the nation’s largest publicly funded organization devoted to real estate research. Learn more about our history here and meet our team.

Helping Texans make the best real estate decisions since 1971.

You are now being directed to an external page. Please note that we are not responsible for the content or security of the linked website.