Covering Your Assets

Running a brokerage business through a business entity such as a corporation, LLC, or partnership can help protect the owner’s personal assets from liability associated with brokerage activity. Understanding the different structures and TREC requirements for each is key to establishing and maintaining a successful business entity brokerage. |

There are several reasons why a real estate license holder would run a brokerage business through a business entity. Chief among them is protecting the owner’s personal assets from liability associated with brokerage activity. Unless the business entity broker is properly formed and maintained, however, liability protection is illusory, and the whole purpose of running a brokerage business through an entity is defeated. This article addresses the types of business entities available, Texas Real Estate Commission (TREC) requirements, and how to properly maintain a business entity license.

TREC does not regulate the ownership of a business entity. A broker, sales agent, nonlicense holder, or another business entity can own the company. As long as a qualified designated broker is in charge of all brokerage activity for the entity and the entity meets the other TREC requirements for licensure, anyone can own the entity. Understanding the ownership structure and authority is necessary to provide the proper documentation to TREC when applying for or renewing a license or changing a designated broker.

Not All Entities are Equal

The Real Estate License Act defines a business entity as a “’domestic entity’ or ‘foreign entity’ (Section 1.002, Business Organizations Code), qualified to transact business in this state." The types of entities referenced in the Business Organizations Code that are most commonly used for a business entity broker are corporations (both C and Sub-S types), limited liability companies (LLC), and general and limited partnerships. With the exception of general partnerships, all of these entities are required to file formation documents with the Texas Secretary of State.

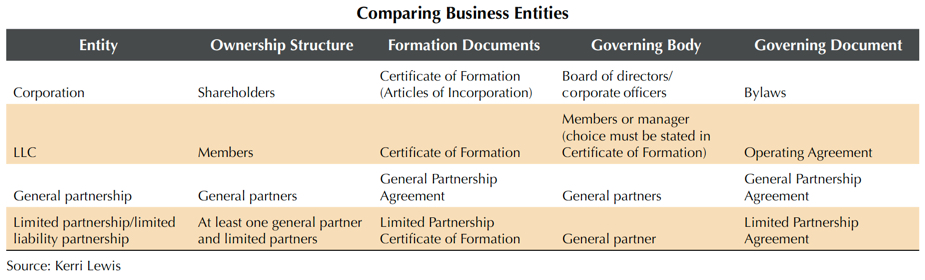

Determining which type of entity to use depends on the management, tax, liability, continuity, and formality-of-operation preferences of each individual and should be discussed with a legal and tax professional. Understanding each entity’s ownership structure and associated management documents is critical. This is true even if a broker owns 100 percent of the company. Different types of documentation are needed for each entity type (see table). Knowing this information will not only greatly assist a license holder in obtaining and renewing a broker entity license with TREC, but in interacting with title companies as well.

TREC Requirements for Business Entity Brokers

According to TREC Rule §535.53, a business entity must be qualified to do business in Texas to obtain or renew a broker’s license in Texas. TREC requires submission of a Franchise Tax Account Status page from the Texas Comptroller of Public Accounts issued within 21 days prior to the date of application as evidence that the entity meets this requirement.

Make sure to file all Franchise Tax Reports and pay any taxes due. A business entity is required to notify TREC no later than the tenth day after the date it receives notice that it is not qualified to transact business in Texas. Should this occur, the entity’s license and the licenses of all sponsored agents will be changed to inactive status until the entity provides proof to TREC that it is qualified to transact business in Texas again.

An individual who holds an active Texas real estate broker’s license and who is in good standing with TREC must be designated to act for the business entity in all brokerage activity. An individual broker is not in good standing if the broker:

- had a license revoked or suspended, including probated revocation or suspension;

- was the designated broker for another business entity that had its license revoked or suspended, including probated, in the past two years;

- has any unpaid or past-due monetary obligations to TREC, including administrative penalties and Real Estate Recovery Trust Account payments; or

- was the designated broker for another business entity that has any unpaid or past due monetary obligations to TREC that were incurred while the broker was the designated broker for that entity.

If the designated broker becomes inactive, is not in good standing with TREC, or dies, the business entity cannot perform brokerage activities, and all sponsored agents become inactive until a new qualified designated broker is approved by TREC. Therefore, it is critical that the owner of a business entity broker monitors the designated broker’s status and has a succession plan in place so swift action can be taken if the designated broker no longer qualifies to act in that capacity. Succession planning for all entity types and individual brokers will be the subject of an upcoming article.

The designated broker must have managing authority for all brokerage activity conducted by the entity. The actual title of the designated broker’s management position will be different based on the type of entity. For a corporation, the designated broker must be a corporate officer. For an LLC, the broker must be a manager or a managing member (or possibly an officer if the LLC’s documentation shows it elected to have officers). For general and limited partnerships, the broker will be a general partner. The business entity must provide documentation to TREC showing the designated broker’s management position to obtain a license or to change the designated broker.

The business entity must provide proof that the designated broker owns at least 10 percent of the business entity or, if the designated broker does not own at least 10 percent, proof that the business entity maintains errors and omissions insurance in the amount of at least $1 million per occurrence.

Proof of managing authority and ownership are necessary when requesting a change of designated broker.

Foreign business entities must provide proof of having a broker’s license in the foreign jurisdiction, such as a real estate license history from another state.

In addition to filing an application for a business entity broker license (online is the best option), applicants must prove that they meet TREC’s requirements. As explained earlier, all types of entities must prove they are qualified to do business in Texas. Documentation for proof of ownership and managing authority, however, differs by entity type (see sidebar).

Protecting Owner’s Assets from Civil Liability

Even if a business entity satisfies TREC’s requirements for licensure, protection of the owner’s personal assets from civil liability is not guaranteed. To take advantage of the personal liability protection, the business entity must be treated as a separate “person" and not be merely the owner’s “alter ego." Texas courts have held the individual owner liable for the debts of a business entity where the owner and the business entity were so unified that holding the entity solely liable would cause an injustice. Commingling funds is one of the main reasons a court will “pierce the corporate veil." For examples, see Watkins v. Basurto, 2011 WL 1414135 (Tex.App.–Houston [14th Dist.] Apr. 14, 2011, no pet.);

Doyle v. Kontemporary Builders Inc., 370 S.W.3d 448 (Tex.App.–Dallas 2012, pet. denied); and

In re Arnette (Ward Family Foundation v.Arnette), 2011 WL 2292314 (Bankr. N.D. Tex. June 7, 2011).

There are four steps a business entity owner can take to maintain a separate identity for the entity.

- Have a governing document signed by the owners of the entity. Because this document is not required to be filed with the Secretary of State, many people fail to complete this important step. The governing document sets out the governing authority for the entity and how the owners of the entity receive distributions of proceeds, transfer ownership, or act on behalf of the entity. Refer to the table to see which governing documents apply to each entity type.

- Establish a separate bank account for the entity, and run all funds received from entity activity through that account. That doesn’t mean the owners can’t subsequently withdraw money from that account. They may, and it is best to do so in accordance with the distribution provisions of the governing document.

- Maintain good entity records. Some types of entities, like corporations, require more formal documentation. Others, like LLCs, are more informal. In all cases, keep separate records for individual owner and entity actions.

- Ensure formal documents, letters, and Commission Disbursement Authorization requests to title companies are signed properly. Don’t sign as an individual when it is entity business. Entity signatures will always start with the name of the entity, followed with a “by" line where the authorized person signs on behalf of the entity and shows the title they hold.

Bottom line: understanding and maintaining good entity documentation and designated broker structure will help keep license holders in compliance with TREC and provide the risk benefits afforded by the business entity.

Nothing in this publication should be construed as legal advice for a particular situation. For specific advice, consult an attorney.

Documents Needed by TREC

The following are examples of documents that will satisfy TREC’s requirements for each entity type.

Proof of Managing Authority

Corporation

- Corporate resolution or meeting minutes signed by directors (chair or all) or all shareholders

(This must include a copy of the Articles of Incorporation, bylaws, or former resolutions or minutes, if necessary, to show who the current directors are or shareholders eligible to sign the resolution or minutes. Pay attention to the title of the resolution and the signatories. TREC has more than once received a resolution of shareholders signed by a director.); - Officers and directors info on the Franchise Tax Account Status page results

(This is a quick and easy way to provide the information if the management has not changed recently.);

- Articles of Incorporation or Certificate of Amendment filed with the Texas Secretary of State’s office

(Certificate of Formation is the new form name for Articles of Incorporation filed with the Secretary of State.).

LLC

- Operating Agreement, signed by all members;

- Officers and directors information on the Franchise Tax Account Status page results;

- Certificate of Formation or Certificate of Amendment filed with the Secretary of State’s office

(These documents show whether the LLC elected to be managed by the members or a manager.); or - Company resolution

(This is like a corporate resolution setting out changes in management or other company action agreed to by the members.).

Partnership

Partnership Agreement, signed by all partners

(This includes limited partners if it is a limited partnership.).

Proof of Ownership

Corporation

- Stock certificates;

- IRS schedules K-1, C, or G; or

- Corporate resolution or meeting minutes signed by directors or shareholders

(This would be used where shares have been transferred and documented in the resolution or minutes. Must include a copy of the Articles of Incorporation and/or bylaws so TREC can trace the chain of ownership.).

LLC

- Operating Agreement or

- IRS schedules K-1 or C.

Partnership

- Partnership Agreement or

- IRS schedules K-1 or C.

____________________

Lewis ([email protected]) is a member of the State Bar of Texas and former General Counsel for TREC.

You might also like

Publications

Receive our economic and housing reports and newsletters for free.