Beyond Austin City Limits

Austin’s growing unaffordability problem has especially affected East Austin homeowners. As a result, they have moved farther from their neighborhoods to purchase more affordable housing. |

Where do homeowners go when their neighborhoods become unaffordable? A growing number of urban communities within larger metropolitan areas are witnessing the dislocation of many of their most vulnerable residents. In Texas, East Austin is a prime example.

Demand factors driving this trend, including Austin’s strong population and employment growth, were discussed in the first article of this series titled “East Side Story." A second article, “Change and Challenges," primarily focused on local supply-side constraints. This article completes the series by examining possible location alternatives for homeowners exiting East Austin.

Obtaining housing a similar distance from downtown is an important consideration for East Austin’s lower-income homeowners who work in the urban core. For decades, Austin’s east side has provided easy access to employees in service jobs critical to businesses located there. Many of the displaced homeowners face significantly higher transportation costs and commuting times along with loss of neighborhood and family ties.

Housing options are limited if they attempt to relocate within Travis County. A surge in the county’s median home prices and apartment rents during the past several years resulted in adjoining counties becoming more affordable alternatives. As a result, all five counties (Bastrop, Caldwell, Hays, Travis, and Williamson) within the Austin Metropolitan Statistical Area (MSA) are included in this analysis.

Detailed tracking of where displaced homeowners have relocated is not possible using currently available data sources. As an alternative, housing affordability and income data across all Austin MSA ZIP codes act as a proxy to illustrate economic and demographic differences by geography.

Although not perfect predictors, affordability, demography, and proximity to East Austin and the urban core provide insight into more likely relocation choices for displaced East Austin homeowners.

Affordable Housing Within East Austin

For the purpose of this study, East Austin is defined as the area within the six ZIP codes listed in Table 1. The City of Austin, several nonprofit organizations, and private developers offer affordable housing to East Austin residents, either individuals or families, that meet the income qualifications.

Affordable units in East Austin belong to one of three programs: the Developer Incentive Program, the Rental Housing Development Assistance (RHDA) Program, or the Acquisition and Development (A&D) Homeownership Program.

The Developer Incentive Program allocates additional entitlements or privileges to developers, such as additional density or height, in exchange for community benefits, including affordable rental and ownership housing units. The RHDA Program includes only rental housing units, and the A&D Program only includes ownership housing units.

Depending on the eligibility requirements of the program, residents must earn a certain percentage of the Austin MSA’s median family income (MFI) to qualify for an affordable unit. Unlike median “household" income (MHI), which is a single number, median “family" income varies by family size.

The U.S. Department of Housing and Urban Development (HUD) annually calculates MFI for program eligibility. Typically, the residents must fit within one of the four income categories shown in Table 2.

HUD calculated $76,800 for the 2015 four-person family MFI for all five counties in the Austin MSA. To qualify for an affordable unit for incomes equal to or less than 80 percent and greater than 60 percent of the Austin MSA MFI, a family must have earned between $46,080 ($76,800 × 0.6) and $61,440 ($76,800

× 0.8). The 2015 four-person family MFI in ZIP 78723 was only $39,360 and $39,307 in ZIP 78752, the only two East Austin ZIP codes reporting income statistics.

The MFI for the two reported ZIP codes was about half that of Travis County. Since HUD uses the Austin MSA’s $76,800 MFI to determine affordable housing qualification, a number of East Austin residents would likely not have sufficient income to qualify for many of East Austin’s affordable units.

According to the Affordable Housing Inventory database managed by the City of Austin, as of January 2017 more than 2,300 affordable units were located within East Austin. This number represents affordable rental and ownership units that have been completed. Almost three-quarters of the affordable units in East Austin are located in three of the area’s six ZIP codes: 78702, 78723, and 78741 (Table 1).

Overall, the number of affordable units within East Austin is similar across the various income categories except for those residents whose income is equal to or less than 30 percent of MFI (Table 2). However, within each of the six individual ZIP codes, the number of housing units offered at each income level varies widely.

Around three-fourths of affordable units within ZIP code 78702, which is closest to downtown, are for residents with incomes equal to or less than 50 percent but more than 30 percent of MFI. Alternatively, the proportion of affordable units in ZIP codes 78723 and 78741 is highest for residents with incomes equal to or less than 80 percent but more than 60 percent of MFI.

Slightly more than 45 percent of all East Austin affordable units are for residents with incomes equal to or less than 50 percent but more than 30 percent of MFI. Less than 5 percent of all units are tailored to residents making 30 percent of MFI or less.

The bulk of East Austin’s affordable housing units—92.3%—are rentals (Table 3). Both single-family and multifamily properties are included. However, housing units offered for ownership are only available to residents with incomes greater than or equal to 80 percent of MFI.

In 2015, the Census Bureau’s American Community Survey (ACS) reported that 60,584 housing units were located within the six East Austin ZIP codes. The 2,383 affordable units represent less than 4 percent of that total housing stock. Even more striking, the 184 affordable housing units for ownership comprise less than one-half of 1 percent of the total stock.

Owner-Occupied Housing

The number of potential ZIP codes affordable to East Austin homeowners looking to purchase another home in one of the six East Austin ZIP codes decreased significantly from 2011 to 2015.

To calculate affordability, this article uses the median multiple, a standardized method for measuring housing affordability developed by Demographia. The median multiple is a simple ratio of median sales price divided by MHI. The Real Estate Center’s median sales price data used in the analysis was restricted to existing single-family homes sold through multiple listing services.

MHI is used in the median multiple calculations rather than MFI to represent all households in East Austin rather than just families. For a more detailed discussion of the median multiple, refer to the methodology section in “Change and Challenges."

The 2011 MHI for East Austin was calculated by multiplying the number of owner-occupied units by the owner-occupied MHI for each of the six ZIP codes. The sum was divided by the total number of owner-occupied units in all six East Austin ZIP codes. The result is a weighted average MHI for East Austin homeowners.

East Austin’s 2015 MHI was calculated using the growth rate in MHI for Travis County from 2011 to 2015 as opposed to East Austin’s MHI growth rate. Owner-occupied MHI for East Austin increased approximately 16 percent from 2011 to 2015 versus just over six percent for Travis County.

The larger percentage increase in owner-occupied MHI that occurred in East Austin is likely the result of higher-income homebuyers migrating into the area. For this reason, the lower Travis County MHI growth rate is considered more indicative of the income growth experienced by East Austin’s long-time legacy homeowners.

The 2011 owner-occupied MHI for East Austin was estimated at $53,339. By 2015, it had increased to $56,730 assuming the 6 percent growth rate in MHI for Travis County. As discussed in “Change and Challenges," MHI in East Austin increased at different rates among the six ZIP codes. Using the Travis County owner-occupied MHI growth rate also controls for the effect of variations in income among the six ZIP codes.

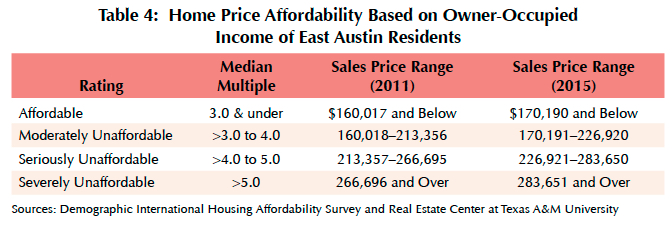

The MHI for East Austin was multiplied by the median multiple to derive the range of home prices within each affordability category (Table 4). For a home in an East Austin ZIP code to be classified

affordable in 2011, the median sales price had to have been $160,017 or less ($53,339

× 3.0). In 2015, the median sales price had increased to $170,190 or less ($56,730

× 3.0).

ZIP codes occasionally overlap county lines. This caused certain ZIP codes to be included in the calculations of more than one county in Table 5.

The East Austin MHI is held constant regardless of ZIP code. Additionally, the median sales price is the same within a particular ZIP code, even if it crosses county lines. As a result, the median multiple will remain the same for individual ZIP codes regardless of county.

The results for more rural ZIP codes are constrained by the limited number of home sales. Any one sale in a sparsely populated county will have a larger effect on the median multiple than it would in more densely populated ZIP codes where there tend to be more home sales.

The median multiple merely provides a benchmark for housing affordability. Due to a variety of individual circumstances, some East Austin residents might purchase a home within a ZIP code not classified as

affordable. However, the increased housing costs that accompany owning a more expensive home, especially property taxes, would be a significant barrier to most displaced lower-income residents.

In 2011, 25 ZIP codes in Travis County were affordable to East Austin homeowners (Table 5). By 2015, the number had decreased by more than half to only 12. This assumes that the income for East Austin homeowners grew at the overall rate for Travis County.

By 2015, compared with Travis County, East Austin homeowners appeared more likely to purchase in Williamson, Caldwell, and Bastrop Counties and slightly less likely in Hays County. In Caldwell and Bastrop Counties, about half of ZIP codes were classified

affordable in 2015 compared with only 18 percent in Travis County.

The portion of

affordable ZIP codes in Williamson County (38 percent) was also higher than in Travis County. In Hays County, only 10 percent of ZIP codes were classified

affordable in 2015, a significant decline from 2011.

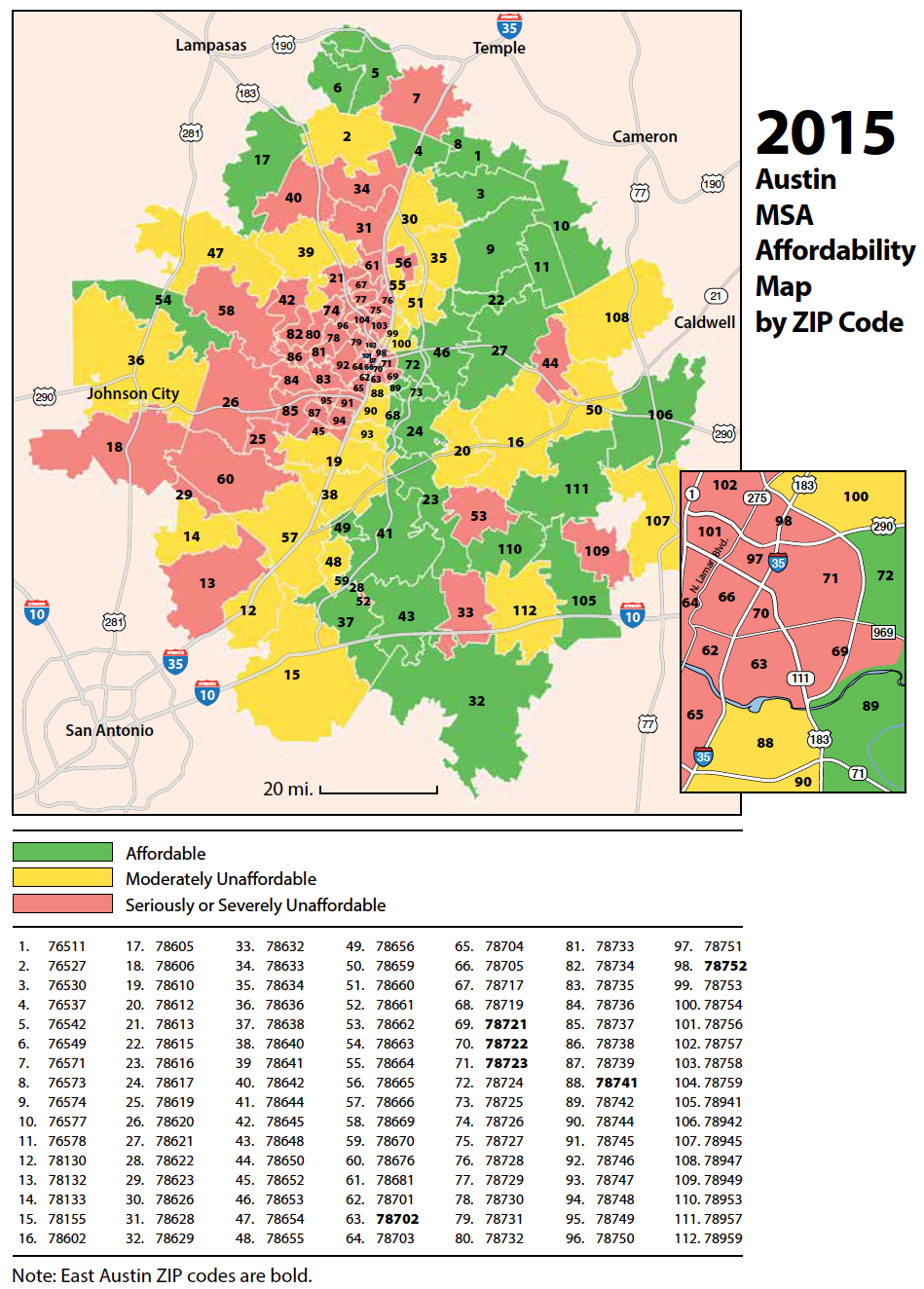

Owner-occupied housing affordability for East Austin residents is contrasted in two maps, one for 2011 and one for 2015. Along with the

affordable category, the maps depict the

moderately unaffordable ZIP codes separately from the

seriously unaffordable and

severely unaffordable categories. The assumption is that some displaced East Austin residents would be financially able to purchase homes in

moderately unaffordable ZIP codes as well.

In 2011, the median sales price for

affordable ZIP codes was equal to or less than $160,017 (based on a median multiple of 3.0). The median sales price for

moderately unaffordable ZIP codes ranged from $160,018 to $213,356 (based on a median multiple of >3.0–4.0). The median sales price for

seriously or severely unaffordable ZIP codes was $213,357 or above (based on a median multiple >4.0).

In 2015, the median sales price for

affordable ZIP codes was equal to or less than $170,190. The median sales price for

moderately unaffordable ZIP codes ranged from $170,191 to $226,920. The median sales price for

seriously or severely unaffordable ZIP codes was $226,921 or above.

In all, 52 ZIP codes in the five counties were classified as

affordable to East Austin residents in 2011 while 27 were

moderately unaffordable, and 31 were

seriously or severely unaffordable. (Two ZIP codes were omitted in 2011 because of no home sales.) By 2015, only 31 ZIP codes were still classified

affordable while 26 were

moderately unaffordable, and 55 were

seriously or severely unaffordable.

Several ZIP codes overlap across county lines. Ignoring the overlap and summing the ZIP codes in individual counties listed in Table 5 yields a larger 76 ZIP codes that were classified

affordable in 2011, dropping to only 46 that were

affordable in 2015.

Using Demographics to Compare Across ZIP Codes

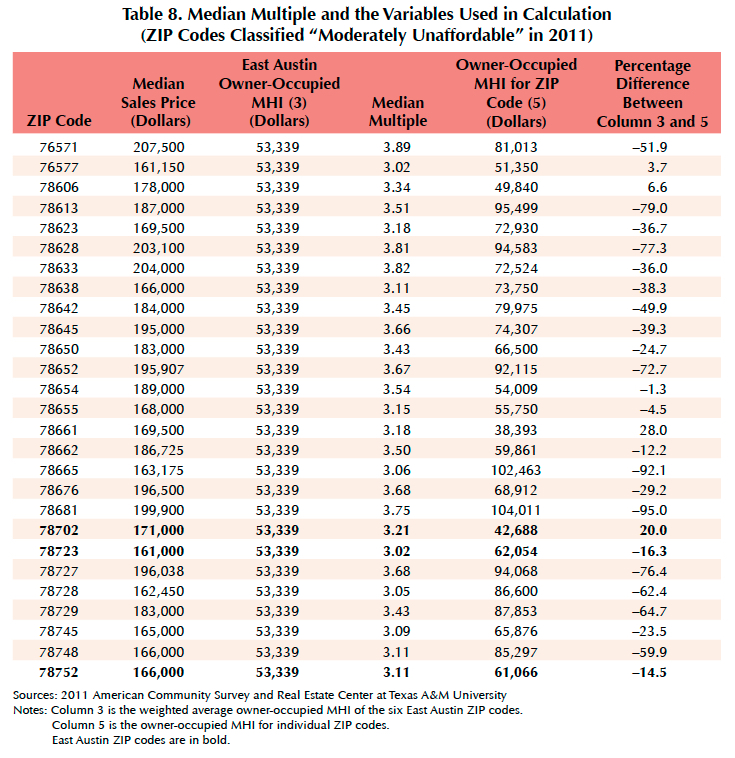

Tracking the exact movements of dislocated East Austin homeowners from one home to another is not possible. To provide further insight into alternative areas they might find attractive, Tables 6 and 7 portray the median multiple and components in its calculation by ZIP code in the

affordable category for 2011 and 2015, respectively. Tables 8 and 9 analyze the

moderately unaffordable ZIP codes for the same periods.

ZIP codes are sorted numerically. The owner-occupied MHI for each ZIP code in column 5 demonstrates that East Austin homebuyers could purchase in some higher-income ZIP codes, depending on home price.

Distance from East Austin and the urban core is helpful in identifying patterns of relocation. This analysis assumes it is more likely for a household to relocate to the more affordable ZIP codes that are closer to those areas.

The maps show that the number of affordable ZIP codes close to East Austin was higher in 2011 than in 2015. In 2011, the ZIP codes closest to East Austin indicate that East Austin homeowners could purchase homes north, east, or south of the area. Only two ZIP codes within East Austin, 78721 and 78741, were affordable to East Austin homeowners in 2011 but not in 2015. In essence, by 2015, an East Austin household earning the East Austin owner-occupied MHI could not afford a median-priced home in any East Austin ZIP code.

In 2015, the ZIP codes closest to East Austin—78719, 78724, 78725, 78742, and 78653—indicate that East Austin homeowners earning the East Austin owner-occupied MHI could purchase homes farther east and south of the area (Table 7). The owner-occupied MHI for these ZIP codes is similar to the East Austin MHI, with the exception of 78719, posing a higher likelihood for relocation. In 2015, ZIP code 78724’s MHI was 13 percent lower than East Austin’s while 78725’s was 9 percent higher, 78742’s was 1 percent lower, and 78653’s was 20 percent higher.

Overall, in 2011, homeowners likely moved north, east, and south (Map 2011). In 2015, homeowners likely moved northeast and southeast (Map 2015).

Assuming some East Austin homeowners could afford to purchase homes priced above the

affordable range, tables 8 and 9 depict the demographic profiles for

moderately unaffordable ZIP codes to East Austin homeowners in 2011 and 2015.

Three ZIP codes in East Austin—78702, 78723, and 78752 were

moderately unaffordable to East Austin homeowners in 2011. By 2015, only one ZIP 78741, was

moderately unaffordable.

Wayne Gerami, vice president of client services at Austin Habitat for Humanity, lives in East Austin. According to Gerami, “for the price I sell my home at, I could get something nicer if I looked farther east, really far south, or out in Bastrop, Del Valle, Pflugerville, or Buda, but then I’d be in a new area, farther from where I work, away from my established support structure."

What the Future Holds

Terry Mitchell, president of Momark Development, emphasized “the loss of community and family relationships is a primary challenge facing homeowners displaced from East Austin. In terms of the construction of affordable housing, most of the affordable products provided are studio apartments. Affordable housing serves few families."

Mitchell also believes a major disconnect exists between the size of affordable units demanded and the size of affordable units supplied. “Developers are struggling to put affordable housing in the form needed," says Mitchell. “Many of our citizens will be renters forever unless their income goes up."

Mounting single-family housing unaffordability will cause long-term East Austin residents to relocate farther from downtown. These residents may face issues related to employment, transportation, schools, and social support systems.

The limited number of affordable housing units within East Austin poses a weak solution to relocation, particularly for those residents who desire homeownership. Ultimately, long-term East Austin residents who sell their homes face increasing separation from the city as they move farther away.

____________________

Dr. Hunt ([email protected]) is a research economist and Losey a research assistant with the Real Estate Center at Texas A&M University.

You might also like

Publications

Receive our economic and housing reports and newsletters for free.