Back to Work

The Takeaway Boosted by both a recovering national economy and recovering oil prices, Texas has recouped more than half of the jobs it lost in March and April 2020. |

During the COVID-19 economic recession, Texas lost more than 1.4 million nonfarm jobs, dropping from a peak of 13 million in February 2020 to a trough of 11.6 million in April 2020, or 10.8 percent loss of total nonfarm employment (Figure 1). Over the same period, the U.S. lost 22.2 million nonfarm jobs (14.5 percent).

The recession’s intensity varied widely across Texas Metropolitan Statistical Areas (MSAs), from a 5.5 percent loss in Sherman-Denison to 14.9 percent in Midland (Table 1). The Real Estate Center found three main factors that explain the recession’s severity across MSAs:

- relative share of employment in the leisure and hospitality and other services industries;

- correlations between the growth rates of the state’s metropolitan jobs and U.S. jobs; and

- the price of West Texas Intermediate (WTI) oil.

These factors have reversed. As a result, MSAs are regaining lost jobs.

Texas Job Losses by Industry

Job losses varied across the state’s industries in the pandemic recession, from as small as 2.5 percent for financial activities to 41.4 percent in leisure and hospitality industry (Table 2). The latter, composed mainly of hotels and restaurants, bore the brunt of the recession followed by other services, mining and logging, and education and health services.

Correlations Between Texas, U.S. Labor Markets

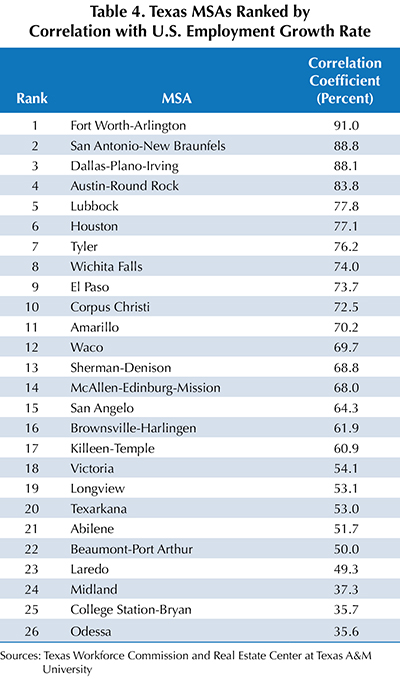

Economically, the U.S. suffered more than Texas in the pandemic recession, and Texas MSAs with economies that closely correlate with the U.S. economy suffered more than MSAs with economies that do not.

Correlations between Texas MSAs and U.S. job growth rates varied from more than 83 percent for Fort Worth-Arlington, San Antonio-New Braunfels, Dallas-Plano-Irving, and Austin-Round Rock to less than 50 percent for Laredo, Midland, College Station-Bryan, and Odessa (Table 4).

Oil Prices Take a Hit

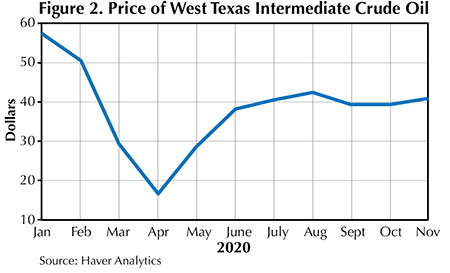

Price of WTI crude oil fell from $57.50 per barrel in January 2020 to $16.61 in April 2020 (Figure 2). Texas metros with larger shares of mining jobs suffered more in the pandemic recession due to the price collapse. In March 2020, mining jobs accounted for 34 percent of nonfarm employment in Midland and 25.6 percent in Odessa. Consequently, these petroplexes bore the brunt of falling oil prices.

By November 2020, oil prices hovered around $40, not sufficient to stimulate overall economic conditions.

Regaining Texas Jobs

On March 5, President Trump signed an $8.3 billion emergency aid package to help combat the coronavirus and its adverse economic impacts. The Federal Reserve stepped in by:

- lowering the Federal funds rate to its zero lower bound;

- helping ensure interest rates will remain low;

- lowering long-term interest rates by purchasing massive amounts of long-term Treasury securities and mortgage-backed securities;

- providing short-term low interest rate loans to security firms (primary dealers); and

- offering Money Market Mutual Fund Liquidity Facility, repurchase agreement (repo) operations, and direct lending to banks, state and local governments, and other credit facilities.

From April to November 2020, the nation gained 12.3 million jobs because of actions by the U.S. government and the Federal Reserve and because of people’s willingness to return to work. The gain accounted for 55.4 percent of jobs lost in the pandemic recession. Texas gained 844,200 jobs (59.8 percent of jobs lost in the recession) but remains more than 474,200 jobs below the year-ago level.

The latest job recovery indicator for Texas, defined as the ratio of the number of jobs in November 2020 to the number of jobs in April 2020 (seasonally adjusted and expressed as a percentage) stood at 95.6 percent (Table 5). The state’s transportation, utilities, warehousing and financial activities industries have recovered more than their job losses, and job recovery indexes among the rest of Texas industries currently vary from as high as 99.3 percent for the professional and business services industry to 81.1 percent for the mining industry (Table 6).

National job gains are helping Texas MSA economies that track closely with the U.S. economy. Meanwhile, oil price recovery is helping metros with larger shares of mining jobs. As of November 2020, Waco ranked first in job recovery followed by Texarkana, Sherman-Denison, Tyler, Austin-Round Rock, and Dallas-Plano-Irving. Midland had the smallest job recovery followed by Odessa, Corpus Christi, San Angelo, and Laredo.

____________________

Dr. Anari ([email protected]) is a research economist with the Real Estate Center at Texas A&M University

You might also like

Publications

Receive our economic and housing reports and newsletters for free.