Monthly Review of the Texas Economy

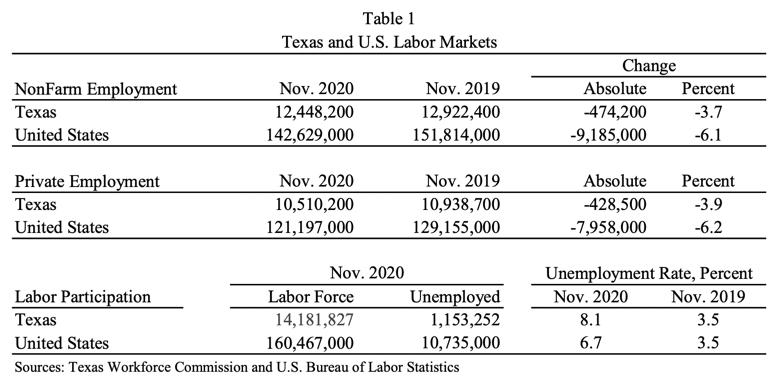

The Texas economy lost 474,200 nonagricultural jobs from November 2019 to November 2020, an annual decline of 3.7 percent, smaller than the nation’s employment decline of 6.1 percent (Table 1 and Figure 1). The nongovernment sector lost 428,500 jobs, an annual decline of 3.9 percent, also lower than the nation’s employment decline of 6.2 percent in the private sector (Table 1). Texas’ seasonally adjusted unemployment rate in November 2020 was 8.1 percent, higher than the 3.5 percent in November 2019. The nation’s rate increased from 3.5 to 6.7 percent (Table 1). The rise in Texas’ unemployment rate in November was due to more people returning to the labor force and seeking jobs.

Texas Employment Percentage Change by Industry

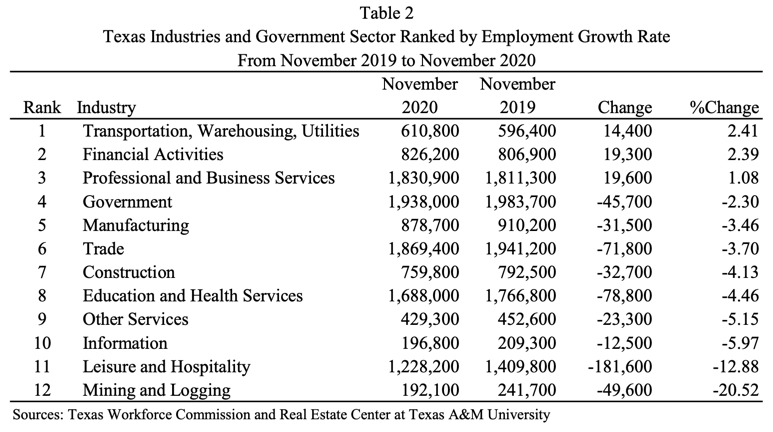

Table 2 shows Texas industries ranked by employment percentage change from November 2019 to November 2020. All Texas industries, except transportation, warehousing, utilities; financial activities; and professional and business services had fewer jobs in November 2020 than in November 2019. Annual job loss rates varied from 2.3 percent in the government sector to 20.52 percent in the state’s mining and logging industry. Figures 2 to 13

(shown in full report) show trends in employment percentage change by industry.

Texas Job Shares by Industry and the Government Sector

Table 3 shows Texas industries and the state’s government sector ranked by their shares of Texas jobs in November 2020. Of the 12,448,200 nonagricultural jobs, the highest percentage was in the government sector followed by trade, professional and business services, education and health services, leisure and hospitality, and manufacturing. Since November 2019, the government sector; professional and business services; manufacturing; financial activities; and transportation, warehousing, and utilities have expanded their shares of Texas employment at the expense of education and health services, leisure and hospitality, construction, other services, information, and mining and logging. Figures 14 to 25

(shown in full report) show trends in shares of total Texas jobs by industry.

Contributions of Texas Industries to Texas Employment Percentage Change

The statewide employment percentage change from November 2019 to November 2020 is the weighted average of employment growth or decline rates of all Texas industries for the period. Weights are shares of jobs by industry. The positive or negative contribution of each industry to the statewide employment percentage change is equal to the employment growth or decline rate in that industry multiplied by its share of Texas jobs. Table 4 shows Texas industries and the state’s government sector ranked by their contributions to Texas employment percentage change from November 2019 to November 2020. All the state’s industries except professional and business services, financial activities, and transportation, warehousing, utilities, had negative contributions. Figures 26 to 37

(shown in full report) show trends in contributions of Texas industries to Texas job growth or decline rates.

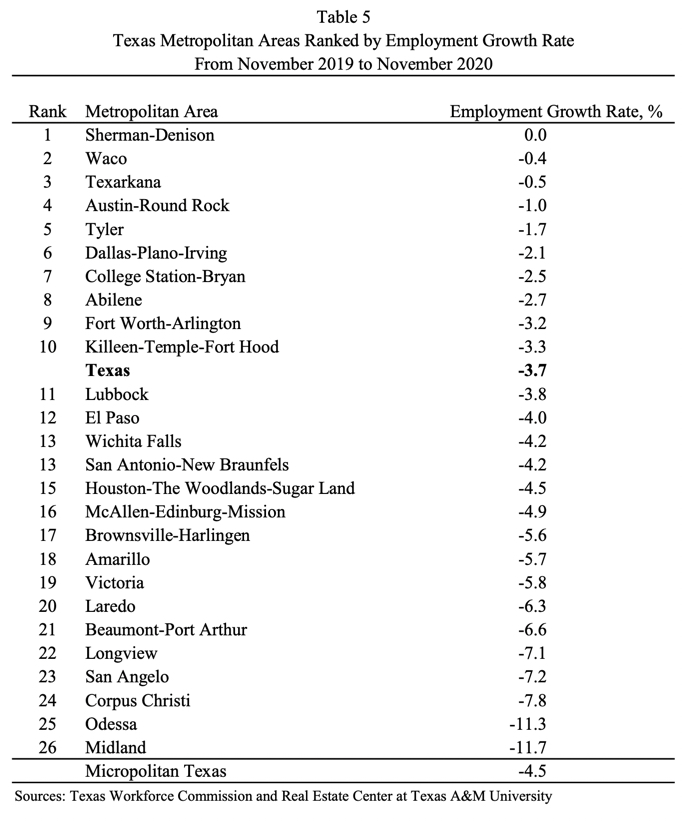

Employment Percentage Changes by Texas Metropolitan Areas

All Texas metros except Sherman-Denison had fewer jobs in November 2020 than in November 2019 (Table 5). Waco had the smallest employment decline rate followed by Texarkana, Austin-Round Rock, Tyler, Dallas-Plano-Irving, College Station-Bryan, Abilene, Fort Worth-Arlington, and Killeen-Temple-Fort Hood. Figures 38 to 63

(shown in full report) show trends in annual employment growth or decline rates for the state’s metropolitan areas.

Texas Job Shares by Metropolitan Area

Table 6 shows Texas metropolitan areas ranked by their shares of total Texas jobs in November 2020. Houston-The Woodlands-Sugar Land had the largest share of Texas jobs followed by Dallas-Plano-Irving, Austin-Round Rock, Fort Worth-Arlington, San Antonio-New Braunfels, El Paso, and McAllen-Edinburg-Mission. Figures 64 to 89

(shown in full report) show trends in metropolitan shares of total Texas jobs.

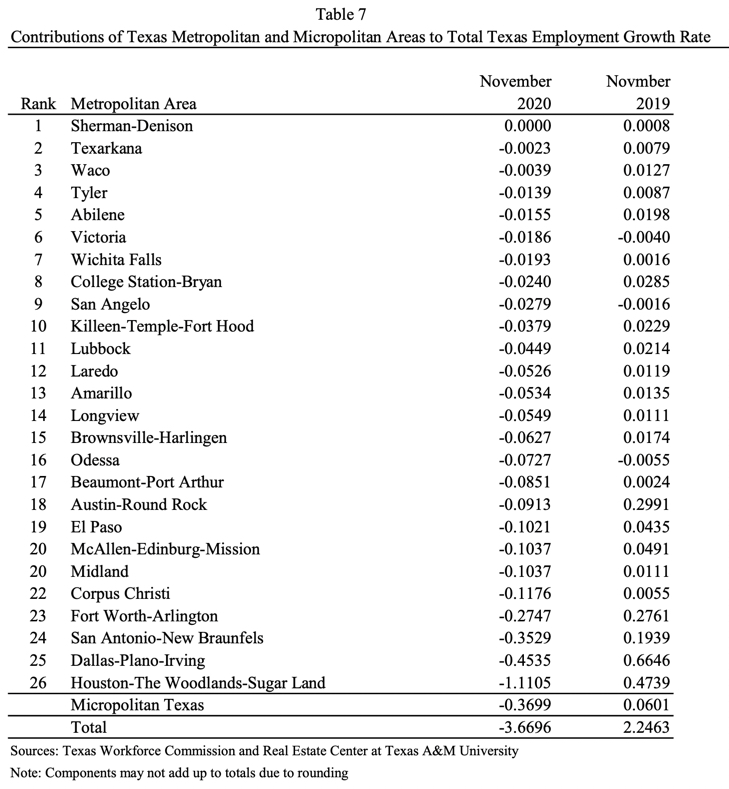

Contributions to Texas Metropolitan Areas to Texas Employment Percentage Change

The statewide employment percentage change from November 2019 to November 2020 is the weighted average of employment growth or decline rates of all Texas metros for the period. Weights are shares of jobs by area. The positive or negative contribution of each metro to the statewide employment percentage change is equal to the employment growth or decline rate in that area multiplied by its share of Texas jobs. Table 7 shows Texas metros ranked by their contributions to Texas’ employment decline from November 2019 to November 2020. Houston-The Woodlands-Sugar Land accounted for the largest percentage of the state’s employment decline rate followed by Dallas-Plano-Irving, San Antonio-New Braunfels, Fort Worth-Arlington, Corpus Christi, Midland, and McAllen-Edinburg-Mission. Figures 90 to 115

(shown in full report) show trends in contributions of Texas metros to total Texas job growth rates.

Unemployment Rate by Metropolitan Area

The state’s actual unemployment rate in November 2020 was 8 percent. Amarillo had the lowest unemployment rate followed by College Station-Bryan, Austin-Round Rock, Abilene, Sherman-Denison, and Lubbock (Table 8).

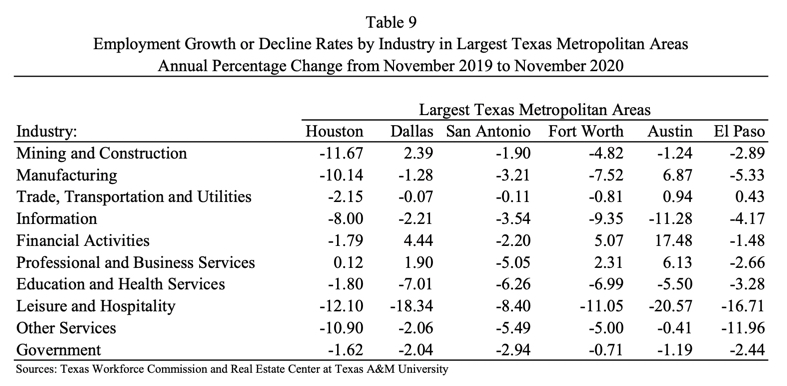

Employment Percentage Changes by Industry in Largest Texas Metropolitan Areas

Table 9 shows annual growth or decline rates of employment by industry in the six largest Texas metropolitan areas from November 2019 to November 2020. The state’s leisure and hospitality industry is bearing the brunt of the COVID-19 pandemic in the major metro areas followed by the information industry and other services industry.

To see the previous month’s report, click here. For the report from a year ago, click here.

Previous reports available:

You might also like

Publications

Receive our economic and housing reports and newsletters for free.