Texas Housing Affordability Outlook

You might also like

TG Magazine

Check out the latest issue of our flagship publication.

Helping Texans make the best real estate decisions since 1971.

As the state’s population grows, so does the need for more housing. Here are the data and tools you need to keep up with housing market trends in your area.

Whether you’re talking about DFW’s financial services industry, Austin’s tech sector, Houston’s energy corridor, or the medical hub that is San Antonio, commercial real estate is big business in Texas.

Mineral rights. Water issues. Wildlife management and conservation. Eminent domain. The number of factors driving Texas land markets is as big as the state itself. Here’s information that can help.

Texas is a large, diversified state boasting one of the biggest economies in the world. Our reports and articles help you understand why.

Center research is fueled by accurate, high-quality, up-to-date data acquired from such sources as Texas MLSs, the U.S. Bureau of Labor Statistics, and the U.S. Census Bureau. Data and reports included here are free.

Stay current on the latest happenings around the Center and the state with our news releases, NewsTalk Texas online searchable news database, and more.

We offer a number of educational opportunities throughout the year, including our popular Outlook for Texas Land Markets conference. Check here for updates.

Established in 1971, the Texas Real Estate Research Center is the nation’s largest publicly funded organization devoted to real estate research. Learn more about our history here and meet our team.

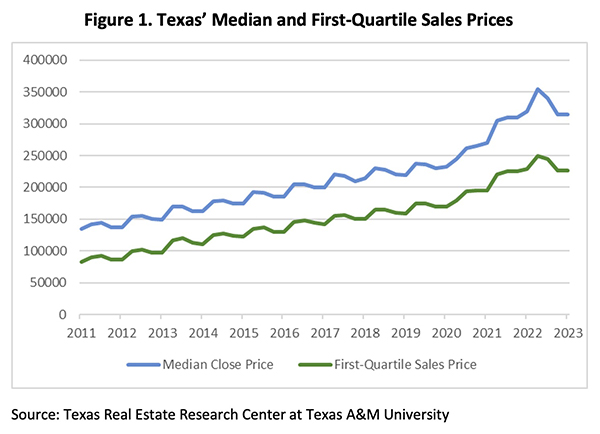

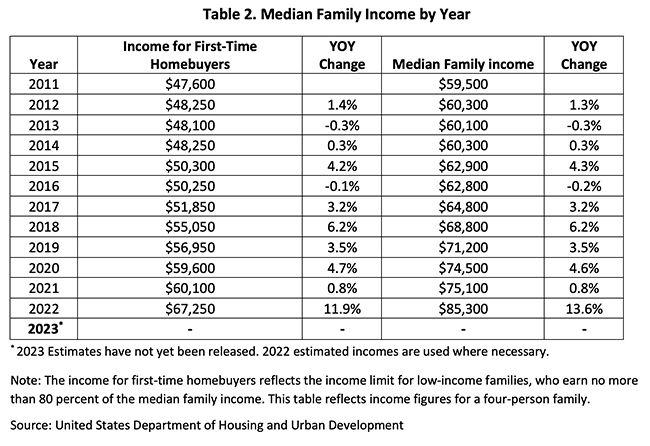

Affordability continued to decline in 4Q2022 amid higher mortgage interest rates and still-elevated home prices. Although home price appreciation declined substantially from record highs observed in the first two years of the COVID-19 pandemic, year-over-year (YOY) growth in both the median and first-quartile sales price remained positive at 1.6 percent and 1.3 percent, respectively (Figure 1 and Table 1).1 The significant YOY increase in family income followed years of modest rises (Table 2). While the rise in median family income (13.6 percent) outpaced the growth in median home price, the substantial uptick in mortgage rates essentially offset the effect of higher median family income.

Rates averaged 6.66 percent in 4Q2022, up considerably from 2Q2022 and 3Q2022, which averaged 5.27 and 5.62 percent, respectively (Figure 2). All other things being equal, lower (higher) mortgage interest rates translate into lower (higher) monthly mortgage payments and ease (diminish) purchase affordability. The Federal Reserve is widely anticipated to raise the federal funds rate an additional 75 basis points in 2023 to reduce inflationary pressures. Expectations dictate that mortgage rates will continue decreasing slightly before settling in the 5 percent range. For more information on the effect of mortgage interest rates on purchase affordability, see "How Higher Interest Rates Affect Homebuying."

____________________

1 The first quartile reflects the lowest-priced 25 percent of homes sold in a particular geography. The first-quartile sales price represents the highest home price among those lowest-priced 25 percent of homes sold. If the price of the lowest 25 percent of homes sold ranges from $100,000 to $150,000, then the first-quartile sales price would be $150,000.

To read this report in its entirety, download the pdf.

Previous reports:

2022: 1Q2022, 2Q2022, 3Q2022

2021: 4Q2021

Receive our economic and housing reports and newsletters for free.

As the state’s population grows, so does the need for more housing. Here are the data and tools you need to keep up with housing market trends in your area.

Whether you’re talking about DFW’s financial services industry, Austin’s tech sector, Houston’s energy corridor, or the medical hub that is San Antonio, commercial real estate is big business in Texas.

Mineral rights. Water issues. Wildlife management and conservation. Eminent domain. The number of factors driving Texas land markets is as big as the state itself. Here’s information that can help.

Texas is a large, diversified state boasting one of the biggest economies in the world. Our reports and articles help you understand why.

Center research is fueled by accurate, high-quality, up-to-date data acquired from such sources as Texas MLSs, the U.S. Bureau of Labor Statistics, and the U.S. Census Bureau. Data and reports included here are free.

Stay current on the latest happenings around the Center and the state with our news releases, NewsTalk Texas online searchable news database, and more.

We offer a number of educational opportunities throughout the year, including our popular Outlook for Texas Land Markets conference. Check here for updates.

Established in 1971, the Texas Real Estate Research Center is the nation’s largest publicly funded organization devoted to real estate research. Learn more about our history here and meet our team.

Helping Texans make the best real estate decisions since 1971.

You are now being directed to an external page. Please note that we are not responsible for the content or security of the linked website.