2021 Texas Housing & Economic Outlook

The COVID-19 pandemic is unlike any disaster the economy has experienced before. Neither the Great Depression nor any recession over the past two centuries caused such a steep economic decline in such a short time. Economic activity rebounded during third quarter 2020 after contracting sharply the previous quarter because of shelter-in-place restrictions. However, the recovery’s strength and pace slowed by the end of the third quarter due to the incomplete reopening of the economy, fiscal stimulus dissipating, and uncertainty regarding the pandemic’s future. Prospects for the economy’s reopening and recovery took an additional hit at the end of 2020 as the number of cases and deaths rose at an alarming rate.

Health outcomes will obviously be key to economic recovery in 2021. The pandemic is expected to be under control by the end of the year, in large part because of the distribution of the Pfizer and Moderna vaccines across the U.S. during the first of half of the year. This will allow for a gradual reopening of economy, especially in the service sector.

The $900 billion COVID-19 Relief Bill approved during the final days of 2020 included direct stimulus checks, payment protection programs to small businesses, and rental assistance. These measures are intended to provide an income bridge for businesses and consumers and help them until the economy can fully reopen.

In addition, interest rates will continue at low levels because of low inflation expectations and the Federal Reserve’s current monetary policy. The U.S. economy is projected to register slow growth during 1Q2021 and accelerate afterward due to effects of the vaccinations and the stimulus bill.

The economy could look different coming out of the pandemic as some changes become permanent. Because this recession was caused by a health catastrophe, the recovery path could be different than that of previous recessions. Consumer and business safety expectations will play an important role in the economy’s full reopening.

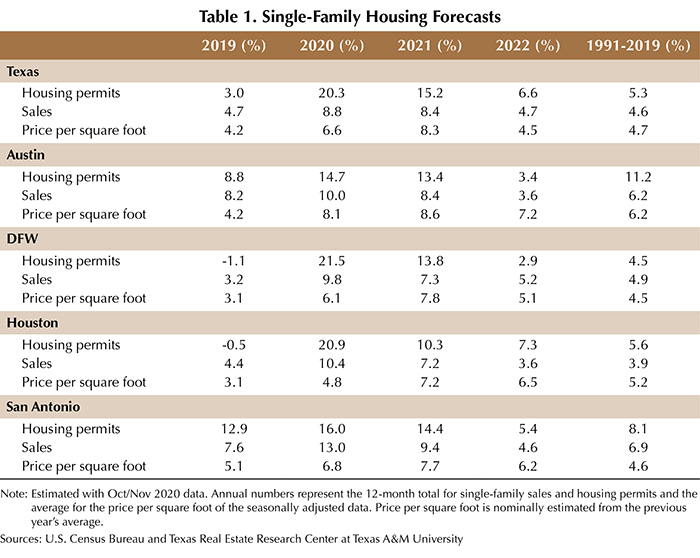

Single-Family Housing

The 2021 housing market will be characterized by strong demand with low inventories accompanied by positive price growth. Inventories of homes priced under $300,000 will be especially low, affecting sales in that price range. Price growth will be positive because of stable demand. Low-skill/low-wage earners were hurt the most economically, and they are typically renters, not homebuyers.

Demographic trends, such as aging millennials and migration from out of state, will help drive Texas housing demand in 2021.

Homebuilders are trying to satisfy demand in the lower price cohorts by building homes in the suburbs or outer city borders where land costs are lower. This trend was prevalent before the pandemic but has accelerated during COVID-19.

Monetary policy implemented by the Federal Reserve, low inflation expectations, and slow economic growth are expected to keep mortgage rates low. Mortgage refinancing, however, will slow as lenders add more requisites and the pool of households able to refinance diminishes.

According to the Mortgage Bankers Association, 2.7 million homeowners (5.5 percent of all home loans) were in forbearance as of Dec. 13, 2020. The share of homeowners who will be able to make their mortgage payments once forbearance ends is unknown, but the Texas Real Estate Research Center expects delinquencies and foreclosures, which have so far been kept low by government policy, to increase during the year.

The Center’s estimated 2021 single-family percent changes for the state and the major Metropolitan Statistical Areas (MSAs) are shown in Table 1.

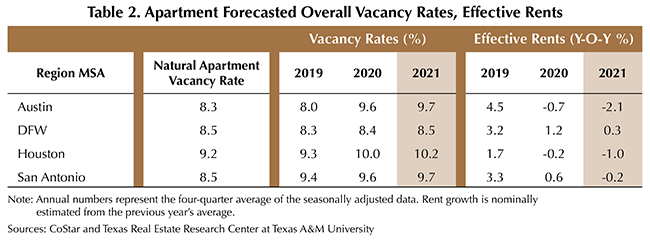

Apartment Market

The fiscal stimulus bill passed in December alleviates some of the apartment market’s issues in 2021. It included direct payments of up to $600 for every adult and child, and it provided $25 billion in rental assistance to tenants with unpaid or overdue rent. It also extended a federal eviction prohibition through the end of January 2021. The incoming administration is expected to renew that prohibition.

The number of tenants who will be able to pay rent going forward is unknown because many renters are jobless, and the ability to pay rent depends on their earning wages or receiving unemployment benefits. This affects landlords’ ability to cover operating costs and make mortgage payments on properties.

The apartment market outlook is worrisome due to the uncertainty surrounding the ending of the eviction moratorium and the dissipation of the fiscal stimulus.

The Center’s estimated 2021 apartment market percent changes for the state and the major MSAs are shown in Tables 2 and 3.

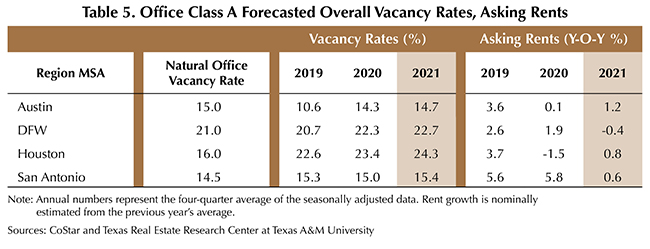

Commercial Real Estate

Trends already prevalent before the pandemic, like working from home and purchasing goods and services online, accelerated in 2020. Remote working took a toll on office vacancy rates and rents even though not everyone could work from home and the amenities some offices provided could not be duplicated at home. Also, relationship-building and networking are difficult when working from home. These elements contradict the idea that on-site office work will disappear in the foreseeable future.

The pandemic accelerated the process of performing some high-tech jobs from home and of doing business online. It created an incentive for the building of more satellite offices in the suburbs or in other cities with lower density, resulting in fewer employees in central downtowns or other high-density areas.

Employees who permanently work from home or move to lower-cost cities may face cost-of-living pay cuts, eliminating the financial gains from working from home or relocating.

Retail was hit the hardest as some businesses were unable to accommodate consumers’ sudden shift from brick-and-mortar shops to e-commerce. On the other hand, the industrial sector benefited from the shift to e-commerce and the accompanying need for additional distributive and warehousing centers closer to the consumer.

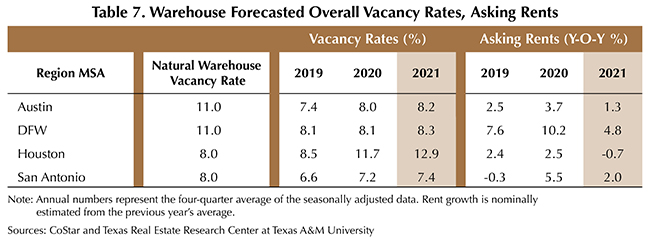

Moving forward, companies will want to spread their risk geographically and minimize the impact of a local problem such as another pandemic outbreak. Warehouse’s strong recent demand could lead to some overbuilding in the future, driven by increasing investor interest in the sector.

During and after 2Q2021, commercial real estate will benefit from the federal government stimulus enacted during the final days of 2020 and the wide distribution of the vaccines.

Based on these expectations, office occupancy will probably not improve significantly until the second half of 2021 when employees could start returning to the office safely. Only then will the effects of remote working be apparent to the office sector. Still, the office market has been exposed to some pervasive underlying changes in the work environment that are not yet fully evident. Given the longer-term nature of office leases, the pandemic’s full impact on the market may not be evident for a couple of years.

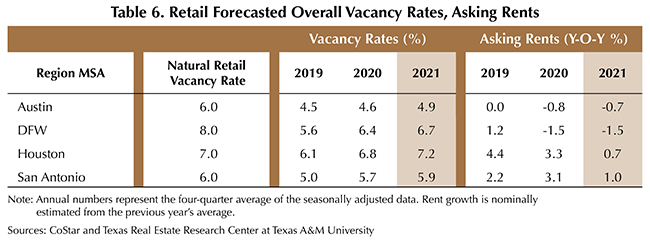

Retail will probably continue to consolidate/contract in 2021. Retail that is more convenient, attractive, pleasing, engaging, or even entertaining may flourish.

Industrial will continue to benefit from e-commerce growth during 2021.

The Center’s estimated 2021 percent changes for commercial space in Texas and the major MSAs are shown in Tables 4, 5, 6, and 7.

Oil and Gas

Oil and natural gas demand is expected to recover in 2021 as the global and U.S. economies rebound from the pandemic. Oil prices could be higher than $50 per barrel because of improvements in economic activity. However, prices in the $50-$60 range will not be enough to create significant employment gains or overall economic improvement. In addition, the incoming administration’s clean energy policy will be a major headwind for the industry.

As it did in the commercial sector, COVID-19 accelerated trends already prevalent in the energy sector and will affect future industry growth and employment. These trends include the rise in environmentally and socially responsible investing and consolidation in a low-price environment.

Rural Land

In 2021, the Center expects:

- overall land prices to increase by 5 percent or more;

- the number of sales to increase by 10 percent;

- total dollar sales volume to increase by 12 percent; and

- small properties to sell well.

Due to stress in the oil and gas industry, Far West Texas markets might not be included in the expansion.

You might also like

Publications

Receive our economic and housing reports and newsletters for free.