Legislative Preview

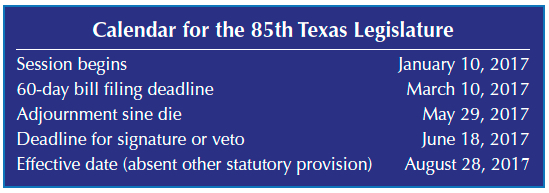

By the time the sun rises on January 10, 2017, we will know the national champion of college football. The black-eyed peas will be gone. Most of the lights and trees will be boxed and in the attic. Returns will be made. Many toys—and resolutions—will be broken, and the kids will be back in school. And on that morning, the 85th Texas Legislature will convene. The legislature convenes for regular sessions for 140 days beginning in January of odd-numbered years.

Here is a brief look at some of the bills that may affect real estate in Texas. This summary concentrates on real estate, but looming over all bills is the budget. Under the constitution and laws of Texas, the state government cannot spend more than it receives in revenue. Largely because of lower oil prices, tax revenues declined in the last biennium, meaning there is less money to spend. Estimated revenues have not been released by the comptroller’s office, but it has been estimated the state will have to cut its budget by four percent.

This summary is based on bills filed. Less than 25 percent of all bills become law. For complete information, read the entire bills in the context of all relevant statutes.

Spending Cap

Speaking of the spending cap, S.J.R. 25 (Van Taylor, Plano) would amend the constitution to require a two-thirds vote of each house of the legislature for an emergency "bust" of the spending cap. Currently only a majority vote in each chamber is required. Keep in mind, however, that the spending cap does not cover the entire budget.

Taxation

Cap on Increases in Appraised Value

H.B. 44 (Mark Keough, The Woodlands) would mandate that tax appraisals may not be increased by more than 5 percent (previously 10 percent) over the previous year. It would also extend this cap on increases to all real property (the current limitation only applies to residence homesteads), and make the corresponding changes to the comptroller’s study determining the taxable value of all property in each school district. The companion constitutional amendment is H.J.R. 17.

Similar limitations would be imposed by H.B. 167 (Cecil Bell, Jr.; Magnolia) and companion constitutional amendment H.J.R. 26.

A similar bill has been filed in H.B. 376 (Will Metcalf, Conroe). That bill would impose a cap on the increase as well, but would not expand application to all real property. The companion constitutional amendment is H.J.R. 33.

S.B. 172 (Robert Nichols, Jacksonville) would provide similar limitations, and also would allow the county commissioners court to ask the voters to approve a higher cap up to a 10 percent increase. The companion constitutional amendment is S.J.R. 19.

Cap on Increase in Appraised Value After Protest and Agreement

H.B. 301 (Lyle Larson, San Antonio) would provide that if, as a result of a protest or appeal, the appraised value of real property is lowered by an agreement between the property owner and the appraisal district, the next year’s appraised value may not be increased without substantial evidence to support the increase, and in no instance by more than 5 percent. (Currently, substantial evidence is required when the protest is heard by the board and/or a court, but not when the appraised value is lowered by agreement. Currently there is no limit to the increase, other than the substantial evidence requirement and the 10 percent cap.) The companion constitutional amendment is H.J.R. 30.

Appraisal Districts

H.B. 85 (Mark Keough, The Woodlands) would provide for chief county appraisers to be elected, rather than appointed by the board of directors of the appraisal district.

H.B. 139 (Cecil Bell, Jr.; Magnolia) would allow a property owner who is protesting her appraisal to require, at her own request and expense, delivery of the hearing notice by certified mail.

H.B. 495 (Dade Phelan, Beaumont) would make changes to the way directors of appraisal districts are selected.

Special Provisions for Disabled Veterans

H.B. 150 (Cecil Bell, Jr.; Magnolia) would extend the tax exemption for residence homesteads donated to partially disabled veterans to homes only "partially donated" at a cost to the disabled veteran less than 50 percent of a good faith estimate of market value. The companion constitutional amendment is H.J.R. 21 (Cecil Bell, Jr.; Magnolia). The Senate bill is S.B. 240 (Brandon Creighton, Conroe) with companion constitutional amendment S.J.R. 23.

H.B. 217 (Terry Canales, Edinburg) would allow disabled veterans to defer or abate collection of property taxes on their residence homesteads. Currently this deferral is available to individuals who are 65 or older, or are disabled. The two statutory provisions governing these issues differ in their definition of "disabled."

H.B. 455 (Will Metcalf, Conroe) would allow a property owner who files a protest with an appraisal review board to appear by telephone at the protest hearing for the purpose of offering argument. Submission of an offer of evidence must be made by affidavit. The language of the bill as filed does not appear to allow the offer of oral testimony by telephone.

S.B. 97 (Bob Hall, Edgewood) would extend the deadline for late applications for tax exemptions available for disabled veterans’ residence homesteads.

Bond Elections

H.B. 151 (Ron Simmons, Carrollton) would require bond elections to be held on the uniform election date in November. A similar bill has also been filed in H.B. 212 (Drew Springer, Muenster).

S.B. 245 (Konni Burton, Colleyville) would require certain information, notice, and public hearings before a bond election.

Disclosure of Sales Price

H.B. 379 (Diego Bernal, San Antonio) would require that in order to be filed for record an instrument conveying real property under a contract for sale must disclose the sales price of the property. Along the same lines, H.B. 182 (Diego Bernal, San Antonio) would require the comptroller to conduct a study of the impact (on the property tax system, property tax revenues, allocation of property tax burdens among taxpayers, and the cost to the state to fund public education) of requiring disclosure of sales prices of real property.

Installment Payments of Property Taxes

H.B. 198 (Diego Bernal, San Antonio) would allow a person who qualifies for a residence homestead exemption to pay property taxes in installments, provided certain conditions are met.

Less Common Agricultural Production Methods

H.B. 231 (Eddie Rodríguez, Austin) would provide that for purposes of determining the appraisal status of qualified open-space land, the chief appraiser would develop guidelines on the degree of intensity required for various uncommon agricultural production methods, such as organic, sustainable, pastured poultry, and rotational grazing.

New Business Exemption for Less Populous Counties

H.B. 102 (Ryan Guillen, Rio Grande City) would allow for an optional exemption from taxation on real property and tangible personal property for new businesses in counties with a population of 250,000 or less. The option would rest with the governing body of the taxing unit. The companion constitutional amendment is H.J.R. 18.

Mineral Interests

H.B. 119 (Tom Craddick, Midland) would make the chief appraiser responsible for ascertaining the ownership of interests in minerals in place on the basis of official records, and prohibit him from requiring operators to provide information as a condition for listing the operator’s interest separately.

Other Exemptions and Special Appraisal Rules

Mineral interests with a value less than $500 are currently exempt from taxation. H.B. 302 (Craig Goldman, Fort Worth) would raise the threshold to $2,000. All mineral interests in each taxing unit are aggregated to determine value. This aggregation provision is part of the current law and would remain unchanged.

H.B. 320 (Terry Canales, Edinburg) would change the "rollback tax" period for a change in land use from five years to two.

H.B. 382 (Jim Murphy, Houston) would provide a property tax exemption for real property leased to an open-enrollment charter school, under certain conditions. The property must be reasonably necessary for the operation of the school, and must be used exclusively for educational functions. The owner must certify by affidavit that the rent will be reduced by the same amount as the reduction in taxes, and must disclose that amount. The companion constitutional amendment is H.J.R. 34.

H.B. 386 (Jim Murphy, Houston) would change the requirements for limitations on appraised value under the Texas Economic Development Act, which creates tax incentives for creation of jobs.

H.B. 445 (James Frank, Wichita Falls) would end tax incentives for wind-powered energy devices within 30 miles of military aviation facilities. This is designed to prevent the devices from interfering with military equipment.

S.B. 175 (Robert Nichols, Jacksonville) would prevent qualified open-space appraisal from losing its eligibility as such when the owner is a member of the armed forces who is deployed or stationed outside the state and intends that the use of the land in that manner and to that degree of intensity be resumed within 180 days of the date the owner ceases to be deployed or stationed outside the state.

Rollback Taxes

S.B. 2 (Paul Bettencourt, Houston) was developed by a committee with the stated goals of simplification, clarification, and transparency of the property tax and appraisal system. The bill would (1) lower the rollback rate from 8 percent to 4 percent; (2) require that, if a taxing unit adopts a tax rate exceeding the rollback rate, a tax ratification election is automatically required (without petition); (3) require tax ratification elections to be held on the dates of general elections; (4) provide for oversight of the property tax process by creating a Property Tax Administration Advisory Board; (5) standardize the deadlines for all property tax protests in Texas to be filed by May 15; (6) require all appraisal districts to use the appraisal manuals issued by the Texas comptroller; (7) establish specialized appraisal review board (ARB) panels to hear more complex taxpayer protests in counties with a population of 120,000 or more; (8) clarify that a majority vote of an ARB is binding for decisions; (9) require protest hearings to be held on Saturdays, or on weekday evenings after 5:00 p.m., and prohibit the first protest hearing from beginning after 7 p.m. on a weekdays evenings; (10) require that all members of the appraisal district board of directors be elected officials within their respective counties; (11) increasing to $5 million the value of properties that have the option of binding arbitration; (12) raise the exemption for business personal property from $500 to $2500; and (13) prohibit local governments from being able to challenge the value of an entire category of properties.

H.B. 345 (Terry Canales, Edinburg) would change the way the rollback tax rate is calculated. The rate would track the effective maintenance and operations rate and would have a capped adjustment pegged to the inflation rate.

H.B. 390 (Donna Howard, Austin) and H.B. 486 (Gary VanDeaver, New Boston) would change the calculation of the rollback tax rates of certain school districts, and call for the comptroller to conduct a study of school tax rates statewide.

Reappraisal of Property Damaged by Disaster

H.B. 513 (Sarah Davis, West University Place) would require reappraisal of property damaged in a disaster as soon as practicable after the disaster to reflect its market value immediately after the disaster. The bill also reassigns responsibility for the appraisal from the governing body of a taxing unit to the chief appraiser of the appraisal district.

Annexation

H.B. 299 (Lyle Larson, San Antonio) would provide for numerous changes in annexation rules. First, a city would not be able to annex an area for the limited purposes of applying its planning, zoning, health, and safety ordinances in the area, even if the city charter says otherwise.

Second, a city would be able to annex an area on the request of each owner of land in the area. In this case, the city must negotiate and enter into a written agreement with the landowners for the provision of services in the area. The city is not required to provide a service that is not included in the agreement. The city must also conduct at least two public hearings at least ten business days apart.

Third, a city may annex an area with a population of less than 200 if the city obtains consent by a petition signed by more than 50 percent of the registered voters in the area. If the registered voters of the area do not own more than 50 percent of the land in the area, the petition must be signed by more than 50 percent of the owners of land in the area. If a petition protesting the annexation is signed by a number of registered voters of the city equal to at least 50 percent of the number of voters in the most recent municipal election, the city must hold an election on the annexation, and the annexation must be approved by a majority of the voters of the city.

Fourth, for areas with a population of 200 or more, the city must hold an election in the area proposed to be annexed, and a majority of the voters of the area must approve the annexation. If the registered voters of the area do not own more than 50 percent of the land in the area, the city must obtain consent through a petition signed by more than 50 percent of the owners of land in the area. Specific procedures for notice and hearing are set forth.

Fifth, the rules regarding the annexation of water or sewer districts are changed.

Dan Huberty of Houston filed a bill similar to H.B. 299 in the last session and has filed H.B. 424 this year. H.B. 424 contains many similar provisions, and would also require the approval of property owners in an area proposed to be annexed.

Water

H.B. 180 (Eddie Lucio III, Brownsville) would repeal the section of the water code that authorizes the state auditor to review whether a groundwater conservation district is operational.

H.C.R. 31 (Drew Springer, Muenster) would urge Congress to encourage the U.S. Department of Agriculture to revise certain water policies of the Federal Crop Insurance Corporation, with a view toward promoting water conservation.

H.J.R. 36 (Mary González, Clint) would amend the constitution to allow the Texas Water Development Board to issue general obligation bonds for the economically distressed program account of the Texas Water Development Fund III, in an amount not to exceed $200 million. The bonds are to be used to provide financial assistance to economically distressed areas of the state as defined by law.

S.B. 189 (Carlos Uresti, San Antonio) would expand the notice requirements for injection wells in or within ten miles of a groundwater conservation district, not including those injection wells used as part of an aquifer storage and recovery project.

S.B. 225 (Van Taylor, Plano) would place conditions and limitations on the referral of water rights application hearings to the State Office of Administrative Hearings.

S.B. 226 (Van Taylor, Plano) would exempt certain applications for amendments to water rights from certain procedural requirements.

H.B. 98 (Armando Martinez, Weslaco) strengthens newspaper notice requirements and requires publication in Spanish for public meetings on a permit issued under the National Pollutant Discharge Elimination System.

H.B. 352 (Andrew Murr, Junction) provides procedures for designating a watercourse a navigable stream for purposes of certain laws, including Chapter 11 of the Water Code; Chapter 21 of the Natural Resources Code; Article 5414a, Vernon’s Texas Civil Statutes; and Article 5414a-a, Vernon’s Texas Civil Statutes.

Eminent Domain

S.B. 243 (Konni Burton, Colleyville) would provide a procedure whereby a property owner could seek the county commissioner’s court’s disapproval of certain proposed eminent domain condemnations. Exercise of eminent domain authority would be prohibited unless a majority of the commissioner’s court approves the condemnation of the property.

H.J.R. 40 (Mike Schofield, Katy) would amend the constitution to provide that in the case of an eminent domain condemnation, if a public use is canceled, if no actual progress is made, or if the property is unnecessary for the public use, the governmental entity is required to offer the property for resale to the person from whom it was acquired at the price paid at the time of acquisition.

H.B. 528 (Mike Schofield, Katy) would, for purposes of the right of repurchase of a person whose real property is acquired by an entity through eminent domain for a public use, increase the requirements for what is considered "actual progress," as set forth in the property code.

Housing

Texas law provides that a person may not discriminate in the sale or rental of a dwelling because of race, color, religion, sex, familial status, or national origin. Furthermore, membership or participation in the multiple listing service (MLS), a real estate brokers’ organization, or brokerage may not be denied on these bases. It is a Class A Misdemeanor for a person to use force or threat of force intentionally to intimidate or interfere for these reasons. H.B. 192 (Diego Bernal, San Antonio) would add "gender identity or expression" and "sexual orientation" to all of the above provisions. Additionally, the bill would provide that a religious organization may limit the sale, rental, or occupancy of dwellings that it owns or operates for other than a commercial purpose to persons of the same religion, and may give preference to persons of the same religion, unless membership in the religion is restricted because of race, color, sex, disability, familial status, national origin, sexual orientation, or gender identity or expression.

Affordable Housing

H.B. 470 (Eric Johnson, Dallas) would allow certain cities to implement homestead land bank programs.

Transportation

H.B. 141 (Richard Peña Raymond, Laredo) would prohibit the Department of Transportation (TxDOT) from operating SH 255 in Webb County as a toll project.

H.B. 303 (Joe Pickett, El Paso) would require money spent on toll road facilities to be repaid. Previously, the Texas Transportation Commission was allowed to require repayment. This bill makes repayment mandatory.

S.B. 114 (Donald Huffines, Dallas) would phase out and ultimately eliminate expenditures on construction and acquisition of toll facilities.

Utilities and Security

H.B. 407 (Tony Tinderholt, Arlington) would require the Public Utilities Commission to identify and implement design standards for the electric power transmission and distribution system to limit electromagnetic field levels and protect the transmission and distribution system. The bill would establish a task force to study measures to protect the electric power transmission and distribution system against all hazards, and would require that electromagnetic field levels be considered when determining public need for a transmission line.

S.B. 83 (Bob Hall, Edgewood), would create organizations for the purpose of developing comprehensive plans to prevent "electromagnetic, geomagnetic, and cyber-attack threats" to "energy-critical infrastructure" and to recover in the event of an attack or failure.

S.B. 248 (Charles Schwertner, Georgetown) would provide procedures for dissolution of special utility districts after the transfer of all obligations and services.

Private Property Rights

Under Texas law, drone surveillance is illegal unless it’s done within 25 miles of the U.S. border with Mexico. H.B. 106 (Armando Martinez, Weslaco) would do away with that exception.

In handgun-related legislation, H.B. 497 (Matt Rinaldi, Irving) would provide that a business where the carry of a handgun is not otherwise unlawful is immune from civil liability with respect to any claim that is based on the business’ failure to forbid carrying of a handgun. H.B. 447 (Cecil Bell, Jr.; Magnolia) would make a business that prohibits lawful carry of handguns liable for damages caused by prohibiting the handguns. Additionally, H.B. 447 would make a business that allows lawful carry of handguns immune from damages arising from lawful carry.

H.B. 522 (Mike Schofield, Katy) would further limit property owners’ associations’ authority to enforce or adopt restrictive covenants that limit religious displays of owners or residents.

H.C.R. 30 (Drew Springer, Muenster) would urge the United States Congress to affirm the provisions of the Red River Boundary Compact and to acknowledge that the vegetation line on the south bank of the Red River forms the boundary between Oklahoma and Texas. The U.S. Bureau of Land Management has previously indicated a desire to claim as many as 90,000 acres of privately owned Texas land as federal lands.

S.B. 65 (Judith Zaffirini, Laredo) would provide for stricter enforcement of laws prohibiting discrimination by cemetery organizations.

S.B. 62 (Judith Zaffirini, Laredo) would amend the Texas Highway Beautification Act to allow political signs to be erected on private property from 90 days before early voting in an election until ten days after the election date.

S.B. 177 (Van Taylor, Plano) would provide for forced unitization for secondary and tertiary recovery operations in oil and gas.

Property Insurance

H.B. 454 (John Cyrier, Lockhart) would require that a lender must notify the insured of her options before applying insurance proceeds for damages to a residence to the loan balance.

___________________

Adams ([email protected]) is a member of the State Bar of Texas and a research attorney for the Real Estate Center at Texas A&M University.

In This Article

You might also like

Publications

Receive our economic and housing reports and newsletters for free.