Impact Fees and the Costs of New Development

As cities grow, the increases in population and business activity almost necessarily entail increases in local governmentally provided infrastructure. Needs or wants for new infrastructure and government services typically follow increased development.

Local politicians and existing voters sometimes balk at the need for new tax revenue required to pay for new development. Some, such as city leaders, may argue poverty. Others talk about a sense of unfairness that general tax revenues pay for infrastructure that serves only newcomers.

Impact fees offer one potential solution. These fees, which are imposed on new real estate developments during the development process, may pay for government infrastructure needed to serve those new developments.

Chapter 395 of the Texas Local Government Code is the authorizing law for local government impact fees. The Texas Real Estate Research Center previously discussed what local governments must do to impose impact fees (“Impact Fees: Paying for Progress," July 2007) and how those fees are calculated (“Impact Fees: Crunching the Numbers," October 2007). This report talks about potential economic justifications for impact fees.

Chapter 395: A Quick Review

As already mentioned, Chapter 395 is the law that allows local governments to impose impact fees. Impact fee uses are limited to funding capital payments on roadway, water, wastewater, and flood or stormwater drainage infrastructure. Normal, ongoing payments for maintenance and operations, as well as any capital costs for other government services (for example, new schools, fire stations, or other government buildings or infrastructure) are not permissible uses for impact fees.

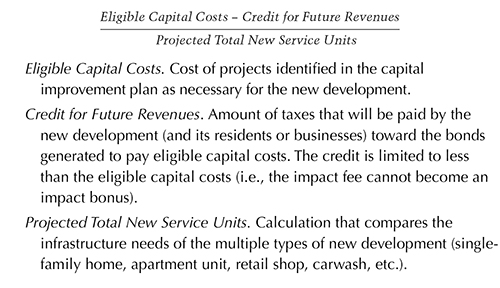

The general process starts with developing a land-use plan (to identify projected development growth) and a capital improvements plan (to identify infrastructure needed to serve the new development), and ends with a straightforward calculation:

This calculation produces the maximum impact fee the local government can charge. However, the municipality can choose to charge a lower amount. The formula expresses the costs of infrastructure required from the local government to serve the new development, less the tax revenues the new development will generate to pay for it. The service unit calculations divvy those excess costs among the expected individual use types and projects within the new development.

What Drives Impact Fees?

A precise calculation of the future costs and revenues from expected developments is difficult. This report discusses on a more theoretical level why and when the previous calculation (precisely estimated) may be expected to be positive. It is easy to see the new infrastructure that new development requires, so one question is, why wouldn’t new tax revenues be sufficient to support the new infrastructure?

Suppose you have a growing small town. Voters have agreed on a level of government infrastructure and services and a tax rate they believe can support that level of infrastructure and services. If a new development is exactly the same as an existing development, only on a different parcel of land, then, yes, it will require new infrastructure. However, if existing tax rates are able to provide a suitable level of service to the existing development, why isn’t the tax rate suitable for similar new development?

Alternatively, imagine the same small town but with much faster growth, such that it will double in size resulting in a separate, newly created municipality. Again, if the residents of the existing small town are happy with the balance of government services and tax rates, why would it be necessary for the new exact replica to have different tax rates or charge over and above those tax rates through an impact fee? Under Chapter 395, if an impact fee is justified without an adjustment in tax rates, it may be because the per-unit expected costs (or revenues) of serving this development is higher (or lower) than those in the existing municipality. What are some reasons for this?

Distance from Center

As a city grows outward from its center, the nexus of the city tends to stay closer to the center. This means, a new development two miles from the edge of town will generally require that new infrastructure be extended from town. Furthermore, because residents of this new development will often travel into the town center, the town’s existing infrastructure may also need to be expanded. Even if the existing infrastructure does not need to be expanded, it will incur greater wear and tear because of the new development.

Consider Brazos County, at the approximate center of which sits Texas A&M University, Bryan, and College Station. The intersection of Texas Ave. and University Dr. is on the university’s border and almost on the Bryan-College Station border. It will be treated as the county’s center for this example.

The U.S. Census Bureau provides estimates of average commute times to work by census tracts. Commute times by the census tracts in Brazos County are shown on Map 1. Figure 1 graphs the relationship between commute times and the distance of the centroid of each Brazos County census tract from the intersection of Texas Ave. and University Dr. Both Figure 1 and Map 1 clearly show that the farther away people live from Brazos County’s economic center, the more they must drive to go about their daily business. This is because services like grocery stores, doctor’s offices, and shopping centers tend to be more concentrated near a region’s economic center than residences are.

As a cost measure, the variance in travel times underestimates the costs of living farther from a town’s center because travel is typically faster on the outskirts of town. A more accurate measure would be miles traveled, which is more directly related to the need for infrastructure and the wear and tear placed on that infrastructure.

Density

Another driver of variable costs of new development is the density of development. If lots within a new development have a 40-foot frontage, each house needs 40 feet of roadway, water, and wastewater infrastructure in between to bring service to them, within the neighborhood, as opposed to the 100 feet of infrastructure needed for 100-foot lots.

Within a new neighborhood, infrastructure is typically provided directly by the developer, so the impact fee doesn’t apply, but the same principle applies across more or less dense neighborhoods that require connections to a city’s water mains. Also, while the developer bears the upfront costs, maintenance and eventual replacement costs are covered by the city, and they scale in a similar fashion with density. In the most extreme cases, infill development, or densification within already existing development with already existing infrastructure, may not require new infrastructure.

School bus service, although not susceptible to impact fees, is another example. As a development becomes denser, buses don’t need to travel as far or make as many stops to pick up the same number of children. Likewise, fire and police emergency response teams don’t have to travel as far to serve the same number of people. Any government infrastructure or service, covered by impact fees or not, that must be provided where the citizens live will become more expensive at a given service level as citizens are more dispersed.

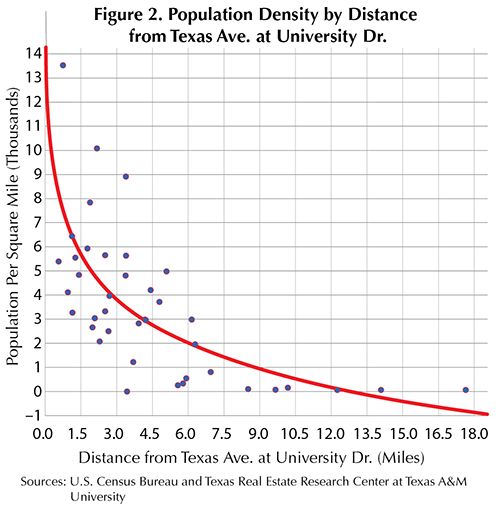

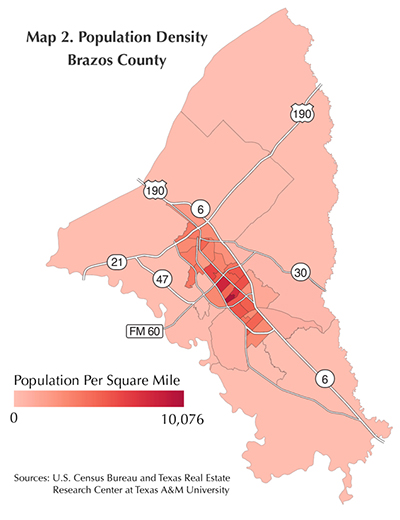

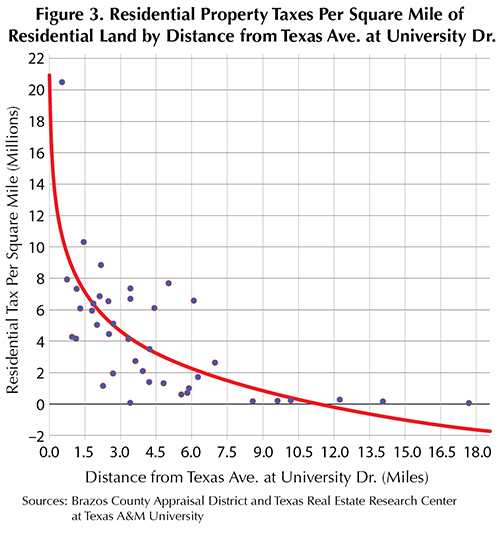

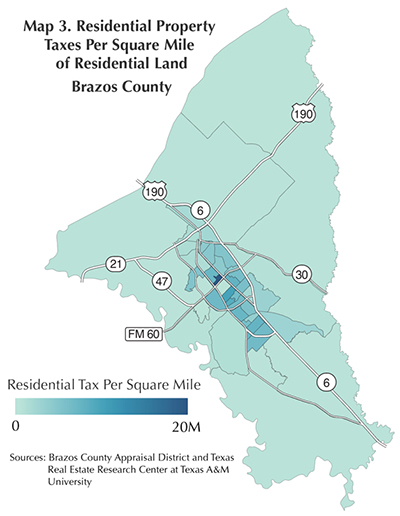

Furthermore, as development densifies and the cost of infrastructure provision falls, tax revenues per square mile often also increase. Figure 2 and Map 2 show the positive relationship between population density and proximity to Texas Ave. at University Dr. at the census tract level, while Figure 3 and Map 3 show taxes per square mile of residential land also increase with proximity to the center of town.

This report provides a theoretical example of why average costs might increase or average revenues might fall with new development. If average costs and tax revenues stay constant with new development relative to existing development, it becomes unclear that new development imposes an unfair financial burden on existing taxpayers.

Changes in density and distances are only two of a number of possible—but not always necessarily applicable—reasons why new development may impose a greater than average burden on city services. Cities may want to keep this kind of variation in mind while developing an impact fee proposal and scaling the charges. The city may want to consider the specific characteristics of a new development and propose an impact fee that reflects that development’s infrastructure needs.

You might also like

Publications

Receive our economic and housing reports and newsletters for free.